30 Days to November

From Collapse to Cash Cow - The Quiet Comeback of the Florida Insurance Specialists

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

The Collapse

The Comeback

Names to Consider

The Collapse

Ambulance chasers. Roofers. What?

The Florida insurance market was pushed to the brink of collapse in 2022 due to a highly litigious practice known as assignment of benefits. What started as a cottage industry in the early 2010’s quickly grew into a parasitic billion dollar combination of inflated claims, fraud, and millionaire sportscar-driving lawyers known for tying insurance companies up in court for years over roofing claims.

On face value, assignment of benefits is a simple tactic designed to make the insurance claims process easier. An individual claimant, whether for health, auto, or homeowners insurance gets immediate relief (surgery, auto repairs, emergency home restoration services) in exchange for assigning the financial value of their claim to a third party company, who then works out the cost with the insurer and receives the settlement.

The obvious issue with assignment of benefits is it creates a perverse incentive for repairs to be as expensive as possible. If you are a third party and know an insurer is going to pay you, you’re going to charge as much as you can legally get away with for repairs.

Florida roofers quickly realized they could turn roofing damage into a billion dollar industry by aggressively soliciting business. Highways were dotted with advertisements for “free roofs” and the practice soared in popularity from 2015-2022. After all, who wouldn’t want a free new roof?

Given the frequency of hurricanes in Florida, it was an easy tactic to get away with. Roofers simply claimed that regular wear and tear on older roofs (wear and tear is not a covered peril) was in fact hurricane damage, and if insurers wanted to fight this they’d have to go to court against attack dog lawyers who would also demand significant attorney’s fees when the case concluded.

The lawyers almost always won due a concept known as “social inflation” (jurors love sticking insurance companies with massive settlements and siding with the “little guy” as a way of lashing out). Given the cost to even fight a claim ranges from $50,000 - $100,000 in legal expenses, insurers just paid out. To the roofers, it was free money.

The scale and breadth of the shenanigans was widely apparent. News articles and academic studies discovered assignment of benefits claims were typically 30-50% more expensive due to inflated, sometimes fraudulent costs, but insurers had no tools to stop the slow motion train wreck.

Like the story of the scoprion and the frog, eventually parasites get large enough to kill their host. By 2022, after suffering Billions in losses, most insurers were high-tailing it out of Florida and most of those who remained, collapsed.

FedNat insurance, a Florida specialist, saw income plunge from $35 Million in 2014 and 2015 to -$120 Million in 2021, and went into liquidation in 2022.

American Coastal (previously known as United Insurance Holdings UIHC), had its United Property and Casualty subsidiary fall into insolvency, and the stock collapsed from $30 to just 62 cents as net income swung from $40 Million to -$400 Million.

Heritage Insurance faced similar disaster as income plunged from $30 Million to -$60 Million and the stock was “written off” after losing 90% of its value.

By late 2022, it wasn’t a mere corporate issue. State lawmakers began to panic.

Florida’s government runs an insurer of last resort called Citizens. The insurer is only open to homeowners that cannot find insurance elsewhere (at a somewhat reasonable price), and was originally intended to fill very small gaps left by private insurers.

As Gulfstream, United, Fednat, Southern Fidelity, Lighthouse, Avator, and Weston went bankrupt and Farmers, AAA, Allstate, and Progressive fled the state, more and more homeowners flocked to Citizens and it quickly became overloaded. After significant damage from Hurricane Michael (2018 - Category 5, $8 Billion in damage) and Hurricane Ian (2022 - Category 5, $50 Billion in damage), it was clear to even the lawmakers that Citizens was on its last legs.

Faced with the prospect of a total insurance industry collapse, lawmakers had to act.

The Comeback

In late 2021, Florida banned aggressive roof advertisements, and determined that claims for damaged roofs would be limited to actual cash value rather than the cost of a new roof. While this was well intentioned, it did nothing to stop roofers from inflating the “cash value” of old roofs to get away with larger payouts.

In early 2022 as the situation worsened and public outcry mounted, the state established an emergency $2 Billion reinsurance fund to help insurers find reinsurance coverage (a giveaway to private insurers), hoping they would pass some of the cost savings to policy holders. They didn’t.

Faced with an imminent insurance collapse, in late 2022 and early 2023, state legislators chose the nuclear option.

They entirely banned assignment of benefits on new policies, eliminated one way attorneys fees making policy holders liable for their own court costs, and reduced the statute of limitations on property damage claims to just one year.

Assignment of benefits and most fraud ended instantly. Property claims declined 40% in 2023, and insurer’s legal expenses plunged from 10% of premiums to just 3% as they no longer needed to fight frivolous claims.

The effect was immediate and insurance profits exploded higher. Increasing margins were compounded by the fact there were only a few surviving insurers left in the state, meaning there was no immediate competition to take advantage of the gold rush.

Growth accelerated as Florida took steps additional steps to wind down its Citizens Insurance operations. Private insurers were allowed to assume Citizens policies, as long as they promised to not raise premiums by more than 20%. These Citizens “takeouts” are wildly profitable to existing private insurers as they come with lower brokers fees and private insurers don’t have to pay for reinsurance during the first year, providing a significant boost to net income upon policy assumption. Citizens polices have since dropped from a peak of 1.4 Million in 2023 to 800k in June 2025.

Despite the incredible megatrend, the Florida Comeback has gone widely unnoticed. Aside from a few scattered posts and Jonathan Cukierwar’s 20 page write-up on ACIC, it’s hard to find any mention of the turnaround.

Heritage Insurance (HRTG) is up 22x from $1.12 to $25.30. American Coastal is up 41x from $0.29 to $12.07. Universal Insurance Holdings is up 3.5x from $8.39 to $29.84. HCI Group is up 7.1x from $27.65 to $196.94.

While the runup has been incredible, I think further gains are to come.

For starters, we have miraculously made it through hurricane season without any major windstorm incidents. I don’t want to jinx things, but if we get to November 1st without any hurricane damage I believe the entire sector will drift higher as the one year statute of limitations implies wind damage claims for the 2025 and early 2026 period will be non-existent and loss ratios will plunge.

Simply put, you can’t blame roofing damage on a hurricane if there are no hurricanes.

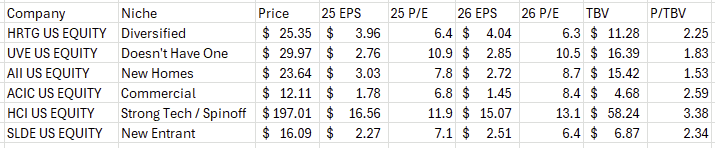

Additionally, the entire sector stands to gain from improved reinsurance pricing.

Insurers never bear the entire risk of their policies since a single hurricane could wipe them out. As a result, all of them purchase reinsurance coverage from larger entities such as Swiss Reinsurance, Reinsurance Group of America, Everest Group Re, Axis Capital, Arch, and Renaissance Insurance among others, to split and cap their risk.

Given the vast increase in profitability in Florida policies, not only are the primary insurers like UVE, HCI, ACIC, SLDE, AII, and HRTG benefiting, the reinsurers themselves are making a fortune since reinsurance payouts are significantly lower. As a result of increased profitability, and no elimination of reinsurance capital due to sizeable hurricane losses, it’s becoming increasingly clear that reinsurance rates for the gulf region are set for double-digit declines in 2026.

Lower reinsurance costs and stunningly low loss ratios will provide a massive tailwind for the entire Florida sector in 2025, 2026, and 2027, but I believe the market is not yet pricing this in for a few select names.

Your first thought might be improved profitability will generate increased competition among the Florida specialists. That’s true. However, homeowners insurance is a very sticky product. Switching insurers is real pain as brokers require intricate wind mitigation reports and extensive documentation to accurately price risk. Unlike reinsurance which is an active, competitive market (insurers are always shopping for the best rates), even if homeowners insurance rates decline 1-3%, to someone paying just $4,000 or $5,000 it might not even be worth the hassle to switch. As a result, the good times should continue to roll for the Florida specialists all the way into 2027. Here’s how I’d play it.

Names to Consider

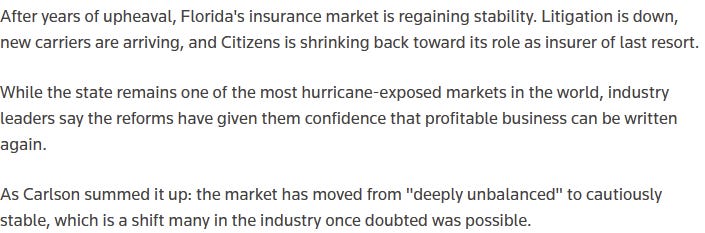

Before I get into the individual trades, I wanted to do a brief overview of the sector, and what the individual insurers are known for.

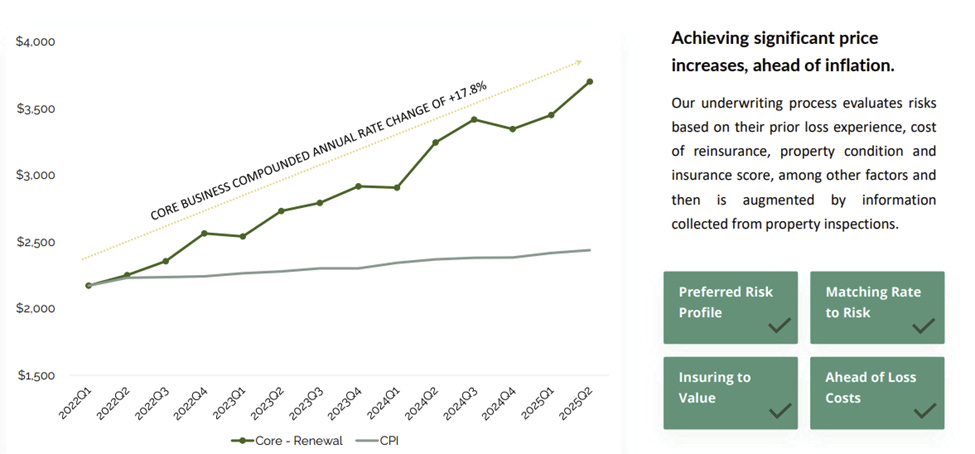

Heritage Insurance has sizeable operations in Florida, and growing exposure to New York and California. Both states have rapidly improving market conditions.

Universal Insurance Holdings has minimal geographical diversification, and is thus highly dependent on Florida insurance rates. While they handled the 2022 implosion better than others, they are still more than 30% below their 2018 high.

American Integrity has a unique focus on new build homes, and intends to significantly expand operations in South Florida, where housing is booming.

American Coastal has deep underwriting expertise and is known for its focus on low-rise apartment and garden style condo buildings. It only covers damage and does not cover liability, lowering its exposure to massive “social inflation” slip and fall claims. It’s also a heavy reinsurance purchaser, and stands to benefit significantly from lower reinsurance costs.

HCI Group is known its advanced risk modelling and expertise on Citizens “takeouts”. Its underwriting model subsidiary, Exzeo, is slated to IPO in 2026. While it may seem expensive on a P/E basis, Exzeo is likely to trade at a significantly higher multiple given the capital-light nature of the business. HCI also has a great track record of Office investments in the Tampa area, which lends credibility to the sharpness of the management team.

Slide Insurance recently went public in June and is a new entrant to the Florida market. Slide touts extensive AI capabilities (which I am not sure of), but it does pursue an interesting hybrid model via an in-house brokerage in addition to partnerships with external brokerages, which lowers its policy acquisition expenses.

Trade 1: Long Heritage Insurance (HRTG)

I think Heritage Insurance is attractive at roughly 6.5x consensus 2025 earnings. Frankly, I think if we make it through to November without a substantial hurricane, it may easily able beat the $0.47 Q3 earnings consensus (which I think has not been adjusted to account for no hurricanes occurring in the period). In an optimistic scenario, Heritage may earn as much as $4.50 this year and next, which would put it at a sub 6x multiple.

While Heritage does trade at a relatively rich 127% premium to Tangible Book Value, I think its strong earnings, geographical diversification, and 2026 growth potential justify a premium to book.

As mentioned on the recent earnings call, Heritage has significant growth opportunities in California and New York, two regions it pulled back from in 2022. Another insurer I follow, Kingstone, frequently pounds its chest on pricing improvements in the New York Region.

While you can’t blame them for celebrating their impressive comeback, Kingstone ironically attracts competitors like Heritage, who used to underwrite in the Long Island region through its Narragansett Bay subsidiary by showing how profitable the state has become. Heritage has the technical expertise and distribution to re-enter this heavily profitable geography, and given they explicitly mentioned they are opening up New York in 2025 and 2026, I think they will make quick progress to seize this opportunity.

Simply put, Heritage has engineered a huge turnaround and stands to gain significantly from lower reinsurance costs in 2026 and an improved 2025 loss ratio provided no hurricane occurs. It’s geographic diversification poises it to gain from improved Florida, California, and New York conditions, yet it trades at an extremely low industry multiple. The lower multiple is likely due in part over damaging claims made in a 60 Minutes Piece. Interestingly, the company has fully denied the allegations and filed a large lawsuit against the adjuster who made these claims in early 2025; either way, if Heritage ever does indeed need to pay a civil penalty, it is unlikely to be material to the company. It would be wrong for me to discuss Heritage without mentioning this risk, which is why I wanted to bring it up.

I think an attractive entry is within the $23.50 to $25.50 range. The stock trades wildly and moves up or down a dollar or two, despite the $750 Million market cap. If you recall, just a few weeks back we had the opportunity to get in a $17.50, and Heritage also traded up to $29.50 in late September before falling 6 dollars in the span of three days. It’s a volatile stock. Given the volatility, I think it’s prudent to consider a starter position at the upper end of the $23.50 to $25.50 range, and leave yourself firepower to get active at the lower end. If you prefer a more conservative entry, selling the December 20 strike puts for 90 cents, which would imply an entry point of $19.10, is also something toconsider. Absent a massive hurricane or terrible regulatory news, I don’t think Heritage trades that low this year and that strong Q3 and Q4 results may propel it to an ideal $30 within the next year.

Trade 2: Short Slide Insurance $12.50 November Puts (SLDE)

There was a recent short report on Slide Insurance, which has spiked the implied volatility of Slide’s options. Slide trades around 6.4x 2026 earnings at $15.99, which is standalone attractive, but I think an even better risk to reward setup is shorting the 12.50 November Puts for 54 cents. That would imply an entry of under $11.96 a share, and I think Slide is unlikely to return to the 12s given its recently announced $75 Million buyback, which should support the stock within the $12.50 to $14 range.

I’d take Heritage over Slide given the geographical diversification, but a sub 12 entry point on Slide is attractive and I am otherwise happy to collect the 52 cent premium if it stays where it is.

Trade 3: Long American Coastal (ACIC) within the $10 - $11 Range

American Coastal trades around 7x earnings and 8x 2026 EPS so it is a little less compelling than HRTG given the valuation and 100% Florida concentration, but I am attracted to its deep underwriting expertise and its capital light Managing General Agent unit, Skywater Underwriters. The MGA takes no risk and operates under a fee-based structure where it underwrites policies and transfers them to a third-party insurer, AmRisc, which is an affiliate of the Chairman of ACIC (who also owns more than $100 Million worth of stock).

The stock is down from its high of $14 last year. I think the $10 - $11 Range represents a compelling opportunity. American Coastal is an excellent underwriter and stands to gain significantly from lower 2026 reinsurance rates. Still, it’s extremely important to pick an attractive entry point for insurers and banks and I think the $10 - $11 Range (7-8x earnings) provides an “easier” entry point with more room for error, than the current $11.90 - $12.10 range. While this trade isn’t immediately actionable, small cap insurers move quickly, and if ACIC enters the $10 - $11 range, I will be adding to my position.

Reinsurance

An interesting way to play the Florida comeback is via reinsurers themselves. While Everest Group, Axis Capital, Arch, etc are all trending higher as the market realizes the prospects of a FL Hurricane are decreasing as we inch closer to the “finish line”, I am not too bullish on reinsurers long term due to the commodity like nature of reinsurance and indications of lower reinsurance pricing in 2026. While reinsurers themselves may experience a bumper profit in Q3 and Q4 of this year, softer reinsurance pricing in 2026 will serve as a headwind, and a tailwind to the primary Florida specialist insurers. Still, reinsurers are likely to beat Q3 and Q4 estimates and present a short term “earnings” setup as they “surprise”, but earnings trades are difficult to structure.

As we inch closer to the end of hurricane season, the entire FL Specialist sector stands to benefit from the first clean hurricane season in years. The setup is simple, if we can make if just four more weeks with no major hurricane activity, the entire sector is likely to blow through Q3 and Q4 2025 earnings estimates.

The group trades at a deep discount to the broader insurance sector and market as a whole, and I think a compelling opportunity is present in names like Heritage Insurance, and (at a lower valuation) American Coastal and Slide Insurance, to gain exposure to growing insurers at extremely low multiples. The broader FL Specialist sector has, for years, been written off as toxic and dangerous, but with litigation reform, lower reinsurance pricing, and stunningly low loss ratios driving profits to record highs, I think the sector is finally ready to let the good times roll.