Chain Bridge Bancorp - Where Political Cash Sleeps at Night $CBNA

Why Bet on Politics When You Can Bank It?

Disclaimer: By continuing to read this article you acknowledge and agree to the terms and conditions at https://www.cluseau.com/p/disclaimer

Quick Stats:

Name: Chain Bridge Bancorp ($CBNA)

Sector: Regional Banks

Price: $26.63

2025 P/E: 11.2x

2026 Forward P/E: 9.0x

Price to Tangible Book: 1.16x

Insider Ownership: 39.5%

Market Cap: $174 Million

Table of Contents:

Pitch

Company Ownership

Risks: Lower Q2 Earnings Relative to Q1

Overall Risks

Model

Position and Trading Levels

Pitch:

In an age where anything tangentially related to President Trump trades at a massive premium, imagine being able to own “The Bank of Trump” itself? With Chain Bridge Bancorp, you can.

Chain Bridge is a single branch bank with exceptional operating efficiency, strong growth tailwinds, and a minimal-risk balance sheet that differentiates it from the Regional Bank peers it is so commonly lumped in with.

Founded in 2007 by retired Senator Peter Fitzgerald (R-Illinois) of the Fitzgerald Banking Family, Chain Bridge declined to go down the traditional brick-and-mortar path and instead made it its mission to provide superb, efficient service to a niche group of clients: Republican Political Organizations.

Chain Bridge’s pitch was simple: “We know Republicans, we bank Republicans, and we have the tools and financial services Republican Campaign Treasurers need to succeed”.

The timing was perfect and Chain Bridge hit the ground running. While other Regional Bank peers were struggling under the weight of the financial crisis, Chain Bridge’s strong capital base, clean balance sheet, and its founder’s intimate knowledge of the complexities of Political Banking vaulted it to the top of the list for Republican Treasurers.

Chain Bridge initially provided banking services for Senator John McCain’s 2008 Presidential Campaign. By 2012, word had spread, and Chain Bridge was not only providing banking services for Mitt Romney’s Presidential Campaign, but also providing secondary banking services for the Republican National Committee and the National Republican Senatorial Committee behind BB&T.

Chain Bridge continued to grow as fast account setups, efficient political Know-Your-Customer capabilities, expansive same-day ACH and wire transfers, and its integral position within the Republican Fundraising Machine set it apart from peers. Bradley Cate, Treasurer of President Trump’s 2020 and 2024 Campaigns described what makes Chain Bridge different:

"When larger banks close their wire at 3:00 pm and someone contacts us at 4:30 pm and they need payment for an event tomorrow, we have to FedEx a check, which is silly. We don't have time to wait for people's lunch breaks. If there's an issue at a large bank, I'm not going to be able to call the head of the bank to figure it out. At Chain Bridge, I have the Chairman’s number"

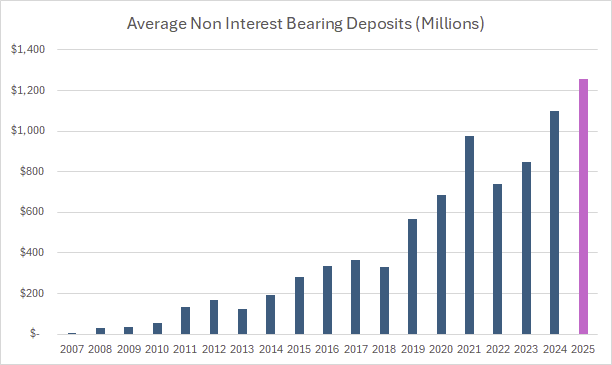

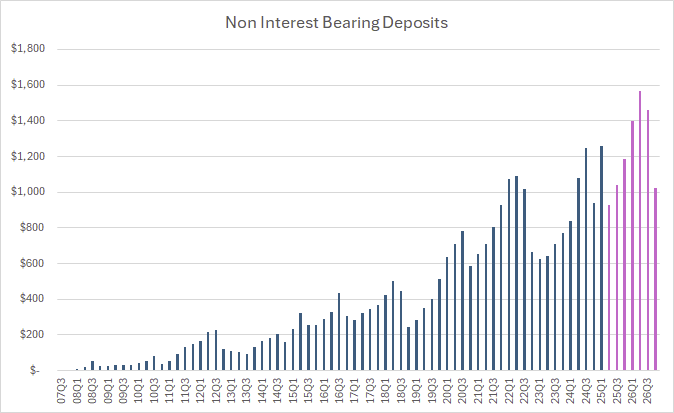

Chain Bridge’s unique pursuit of Republican PAC money has been wildly successful. Chain Bridge’s Breakthrough moment came after it landed Trump’s 2016 Presidential Campaign as a client, and growth has since accelerated as heavy-hitting PACs such as Save America, the Trump Joint Finance Committee, and Congressional Leadership Campaigns continue to shift banking relationships over to Chain Bridge. Growth in the client base and overall political fundraising has propelled average political-related deposits to a record $1.15 Billion in 2024, a gargantuan amount relative to Chain Bridge’s humble $30 Million start in 2008.

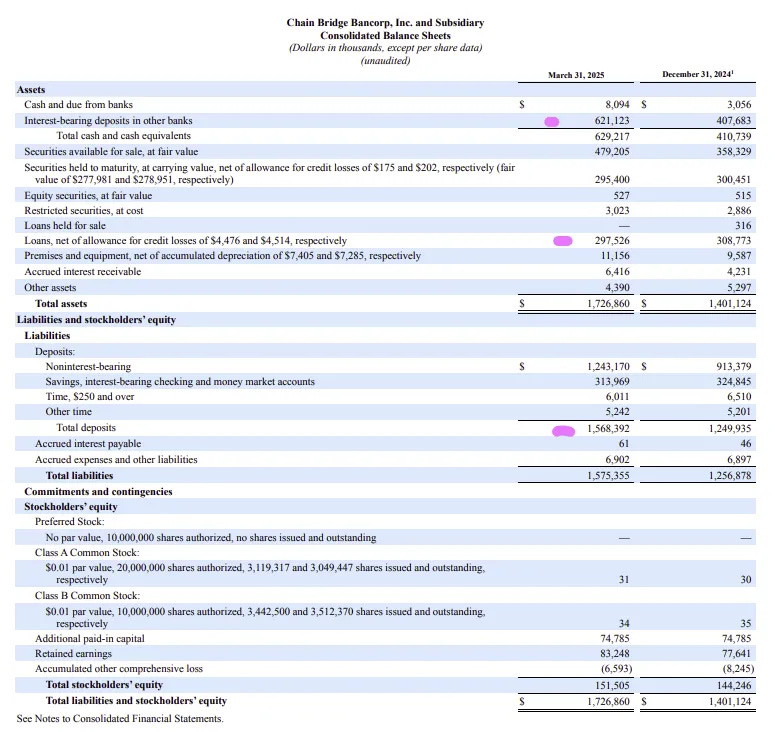

Chain Bridge benefits from a changing election fundraising cycle. Unlike previous cycles where deposits plunged in the two quarters following an election as campaign debts are paid off and final payroll is made, political deposits roared to a record high of $1.256 Billion in Q1, driven by relentless efforts from Republican fundraisers (deposits have since declined in April 2025, more on this later). Much of this effect, seen initially in 2020 and 2022 is attributable to the rise of digital platforms such as “WinRed” which enable fundraisers to aggressively reach out to donors at minimal cost.

Trump’s general distrust of financial institutions like JP Morgan and Bank of America and accusations of “Anti-Republican Debanking” (he is currently suing Capital One) has further elevated Chain Bridge in the field of Political Banking. The message within the Republican party is clear, if you are an ally of Trump, you can’t trust the other banks, you need to move your campaign to Chain Bridge. For instance House Majority Leader Mike Johnson (R-LA) immediately switched his primary banking relationship to Chain Bridge (from Capital One and First Bank and Trust, a local Louisiana Bank) after winning the speakership election in January.

This tailwind benefits Chain Bridge as older Republican congressmen with relationships to traditional banks continue to retire (for example Senator Roy Blunt R-MS, Banking Relationship with BB&T) and are replaced by younger Republicans (Senator Eric Schmitt R-MS, Banking Relationship with Chain Bridge). While Chain Bridge’s growth over the last 15 years is certainly impressive, there is further room to grow.

Now, I know what you’re thinking. How does Chain Bridge make money from this? The answer is quite simple, they get the deposits for free. They pay nothing on political deposits.

If you’re a cynic like me, your mind might immediately race to why aren’t other banks offering higher rates to poach these PACs? The answer is also simple, interest income is more trouble than it’s worth.

Interest income paid to political campaigns is taxable, thus requiring additional compliance and accounting expenditures notwithstanding the tax payments themselves. For smaller campaigns and PACs, the cost of compliance exceeds potential income, and they in fact insist on not receiving interest payments. As a result, the only way banks can compete for niche political deposits is through service and connections, which Chain Bridge excels at.

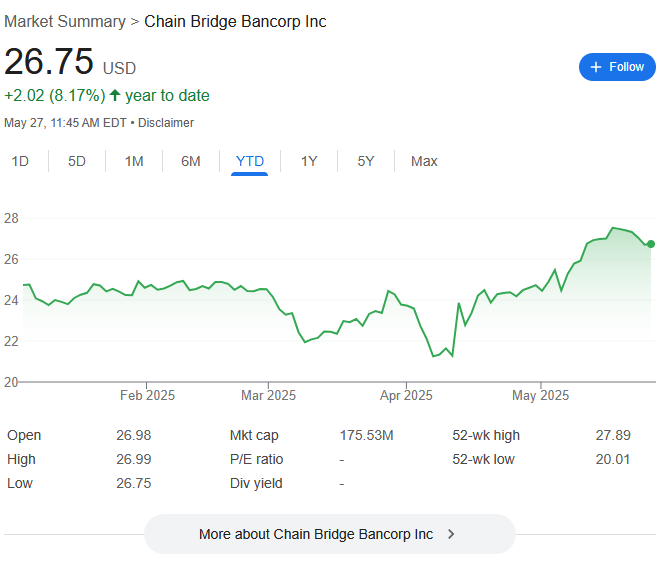

Chain Bridge IPOed in October 2024 to minimal fanfare. The IPO was not well received and priced at $22 (below the guided $24-$26 range) and promptly fell to $20. The move was understandable, in an age when politics has never been more vicious, who would want to own a Republican-affiliated bank going into an election?

The election is now in the rear-view mirror, and Chain Bridge’s Q4 2024 and Q1 2025 results have demonstrated its operating leverage and high potential for growth. Shares have since recovered from the $22 April “Liberation Day” Lows to $26.63, and I think people are beginning to realize something the more they look at Chain Bridge: It’s a business that shouldn’t be valued like a typical bank.

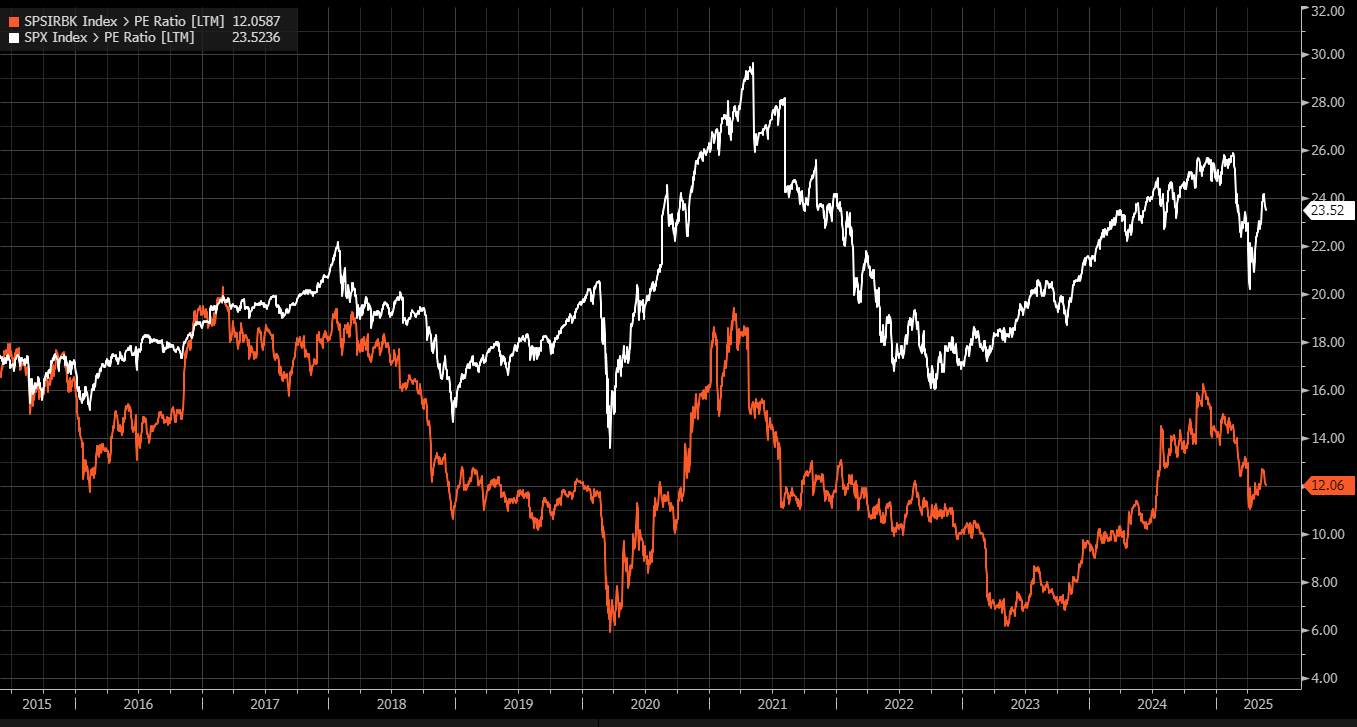

This really deserves a longer discussion, but a good question to ask before considering any bank as an investment is “Why do regional banks trade consistently trade a significantly lower multiple than the S&P 500?”

Aside from a fleeting moment in 2015-2016, Regional Banks routinely trade at a lower multiple, and for good reason. There are three key risks and one constraint present within Regional Banks that don’t necessarily impact other sectors aside from insurance:

Liquidity Risk

Credit Risk and Asset Quality

Interest-Rate Risk

Capital Constraints

For starters, liquidity risk. Even if a bank is highly profitable, if depositors rush to withdraw their funds and a bank lacks sufficient liquidity to cover withdrawals in a short period, boom, it’s a zero. Silicon Valley Bank, First Republic, Signature Bank, the list goes on.

Credit risk. Names like Synchrony (SYF), Bread (BFH), Eagle Bank (EGBN) might all seem cheap at 6x-9x earnings. Why do they trade at just a quarter of the S&P 500 P/E? Is there someone out there determined to keep the price low? Of course not, the reason they trade at a discount is due to credit risk. Unlike names such as Visa, Mastercard, Apple, Costco who might make less money in the event of economic stress, banks with high credit exposure can lose money. In 2022, Equity Research analysts expected Eagle Bancorp to make $5.00 a share in 2022. They ended up losing $1.56 a share. My point is, in an industry where credit risk can easily tank earnings, why would you ever pay the same multiple for a bank as would would for an S&P 500 component that lacks this “blow up” risk?

Interest-rate risk. This one plays into credit risk and liquidity risk; higher rates can reduce the viability of commercial real estate projects and unsecured consumer borrowings (impacting credit risk and asset quality) and also reduce the mark-to-market value of securities holdings (impacting liquidity since banks are reluctant to sell securities they would realize a loss on).

Finally, Capital Constraints. Banks are highly regulated and growth is constrained by the amount of equity capital they have. While an Nvidia-esque name might have significant operating leverage and can able grow revenues 40% or 50% with a constant amount of equity, banks simply don’t have that potential as they’d eventually run out of capital.

The reason I like Chain Bridge is it’s valued at a sub-industry multiple and lumped in with other banks, but it significantly mitigates most of the credit, liquidity, and interest-rate risks as well as the capital constraints that plague other banks. How are they able to do this? They just don’t lend.

The political cycle is extremely quick, and Chain Bridge knows its depositors need to be 100% confident that sizeable withdrawals can be accommodated at a moment’s notice. As a result, Chain Bridge maintains an extremely liquid minimal- risk balance sheet by parking money at the Federal Reserve, at other banks, and in government securities. While this approach might not maximize earnings since the assets carry a lower yield than loans, it minimizes risk.

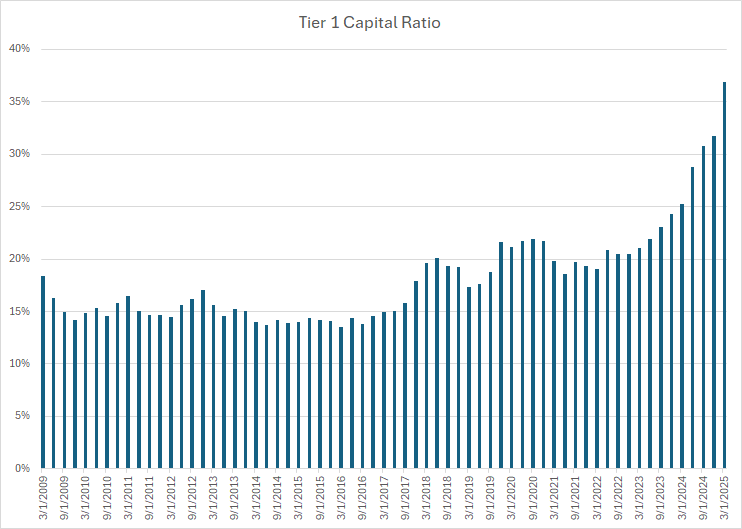

As shown below, Chain Bridge has an industry leading Tier 1 Capital Ratio of 43%, which continues to improve as Chain Bridge’s small municipal securities portfolio rolls off and becomes cash.

Chain Bridge also has an industry low Loan-to-Deposit ratio of just 18% ($297 Million in Loans, Total Deposits of $1.568 Billion).

Within the small $297 Million lending portfolio, credit quality is impeccable. There have been no non-performing loans since 2013, and total charge-offs since the bank’s founding in 2007 are less than $750,000, illustrating the high-quality of the small loan portfolio.

With a significantly less risky balance sheet and higher growth prospects, why is Chain Bridge trading at a cheaper multiple than the index? The opportunity here lies in the fact most people are simply unaware Chain Bridge exists.

The IPO was undersubscribed and if you view the holdings list you’ll quickly see that aside from a few deep-value funds like Gator Capital Management, FJ Capital Management, and Cannell Capital, there is a total lack of institutional ownership. With an average volume of just 12,000 shares (~300k), even those who are aware likely can’t get involved due to liquidity mandates.

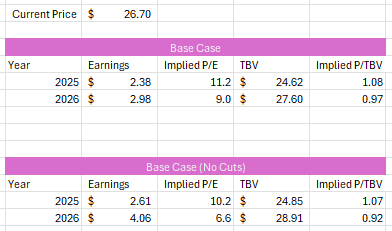

According to my estimates, Chain Bridge is on track to earn $2.38 this year and $2.98 in 2026, putting it at 11x 2025 Earnings and 9x 2026 Earnings. These forecasts take into account a sizable drop in Q2 political deposits.

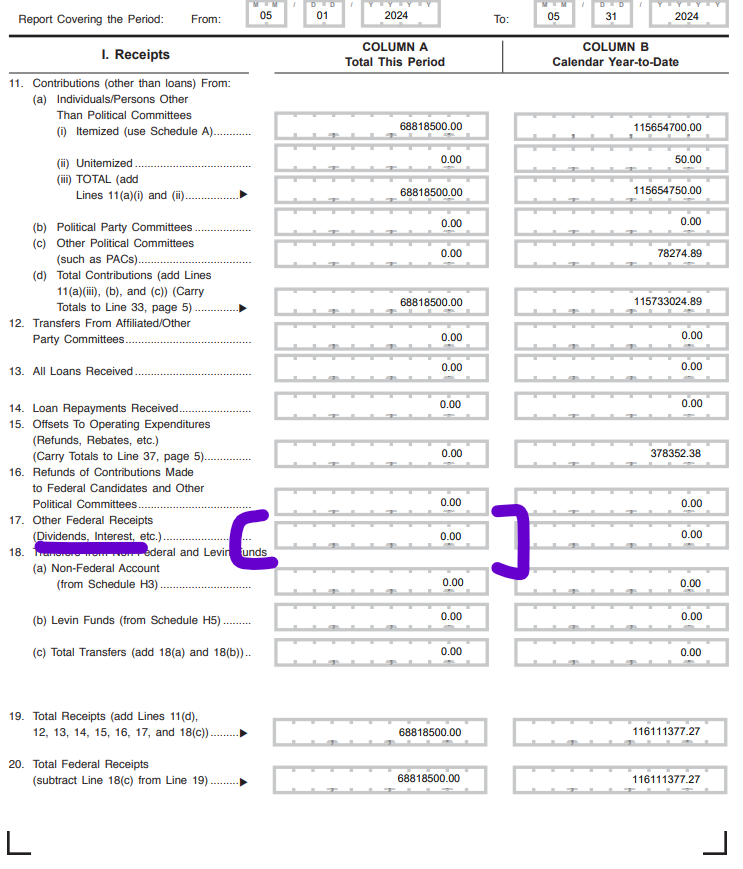

Deposits grew by a record $317 Million in Q1, spurred by an abnormal surge in post election fundraising by the Trump campaign. Chain Bridge’s Q1 10-Q indicates that subsequent to Q1, a sizeable outflow of $506 Million occurred on April 15th across 6 PACs (likely Trump affiliated), and that deposits have since recovered as of May 12th to roughly $1.2 Billion (where they were at the start of Q1). I am not concerned that this indicates Chain Bridge is losing customers, in fact recent FEC Filings by Trump affiliated PACs confirm they are dropping secondary banking relationships and solely banking with Chain Bridge.

I think a more likely explanation of this outflow is that a large portion of the $500 Million was used to pre-pay expenses for the 2025 Cycle (since quarterly bills are due on April 15) and that distributions were made to other committees and organizations. It’s possible that a portion of these outflows are attributable to an organization choosing to invest in instruments like Treasury Bills, but even if this were the case the deposits would eventually flow back to Chain Bridge as all of these organizations maintain their operating accounts at the bank. If anything, I think my model which estimates $0.44 for Q2 and consensus ($0.39, $0.55, $0.70) might be underestimating Q2 earnings. Everyone seems to be expecting lower Political Balances and assuming Q2 fundraising is significantly weaker than Q1. If Trump affiliated PACs raise another ~ $300 Million in Q2, it’s likely that earnings numbers come in significantly higher than anyone anticipates.

Another aspect I like about Chain Bridge is that it serves as call option on higher for longer rates. No bank benefits from higher rates more than they do given the vast majority of deposits are zero-cost. The consensus forecasts already bake in 3 rate cuts by 2026, but if you model zero rate cuts Chain Bridge is on track to earn $2.61 this year and $4.06 in 2026. Simply put, if the ultimate pace of rate cuts ends up being slower than what is currently expected, Chain Bridge will earn significantly more.

Although Chain Bridge is currently trading 15% higher than Tangible Book Value of $23.09 which may seem expensive, I think you can make a very strong argument it deserves to trade at a premium to book with its unique characteristics, especially given that the average regional bank trades at 1.4x Book Value. Additionally, if you had to choose between two banks at 9x earnings, would you opt for the bank with higher growth potential and minimal-risk balance sheet? To me, the answer is a clear yes.

I like Chain Bridge’s management team. Peter Fitzgerald, the founder, remains actively involved as Chairman and CEO John Brough and President David Evinger have been in their roles since the company’s founding in 2006. The three take a combined salary of approximately $1.465 Million, a very reasonable figure against their ownership in the company of 2.6 Million shares ($69 Million, 39% of the company).

In a market where anything tangentially related to President Trump such as the Cantor Fitzgerland SPACs, RTACU, Metaplanet, and even DJT itself trades at an astounding premium, it’s surprising to me that the purest play on Trump’s finances is still attractive. Had Chain Bridge gone public in 2025 via a SPAC, I think it would likely be trading at an astounding premium to book value.

While the stock has run up from its recent “Liberation Day” low of $22, I think at $26.63 it is interesting, and even more so if it happens to trade down into the $25-$26 range. A tactical opportunity is present - Chain Bridge’s impending inclusion in the Russell 2000 Index will lead to approximately 200,000 shares of forced index buying (roughly 15 days of volume) by the end of June, providing significant upward pressure on the price and increasing visibility. Although Chain Bridge’s Q2 earnings will almost certainly come in lighter than its blowout Q1 results, it’s important to note Chain Bridge’s strongest years are ahead of us as the 2026 Midterm Cycle and the 2028 Presidential Cycle ramp deposits from 2026 to 2028. At 11x 2025 Earnings, 9x 2026 Earnings, and just 15% over Tangible Book Value, Chain Bridge at $26.63 provides a compelling opportunity to initiate a starter position in an industry outperformer with a unique story, high growth prospects, a minimal risk balance sheet, and significant upwards optionality if interest rates remain higher for longer.

In an age where the game of politics has never been more about money, Chain Bridge represents a rare opportunity to profit from the “game” itself.

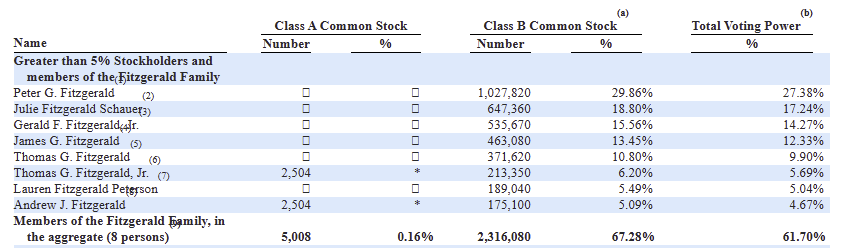

Company Ownership:

Chain Bridge has a dual class structure, with approximately 4 Million Class A Nasdaq-Listed Shares and 2.5 Million Unlisted Supervoting Class B shares. All 2.5 Million Class B shares are controlled by the founding Fitzgerald family, the CEO, and CFO.

Some interesting investors on the ownership list are Gator Capital Management, FJ Capital Management, and Cannell Capital LLC, all of whom were increasing their positions in slightly Q1.

I think the overall lack of Institutional Ownership is indicative of the fact the IPO was retail heavy. This should in theory amplify the impact of Chain Bridge’s addition to the Russell 2000; unlike many names who have significant equity research coverage and institutional owners who may be willing to actively sell in the addition, the overall lack of liquidity for Chain Bridge opens the door to a more volality in either direction.

Risks: Lower Q2 Earnings Relative to Q1

Q2 earnings are likely to come in significantly below Q1 earnings of $0.85 due to a sizable reversal of the deposit surge seen in Q1.

The 10-Q report indicates a sizeable outflow occurred on April 15th, followed by a mild recovery:

On April 15, 2025 a significant outflow of approximately $506.5 million, which the Bank funded using cash reserves at the Federal Reserve, occurred across six political organization client accounts, including the three accounts that exceeded the 5% threshold at quarter-end. As of the close of business on April 15, 2025, the six accounts maintained approximately $56.8 million in aggregate balances. As of the close of business on April 15, 2025, following the outflows, the Company’s consolidated total deposits were $1.1 billion, with one deposit relationship exceeding 5% of consolidated total deposits at 5.15%. As of the close of business on May 12, 2025, the Company’s consolidated total deposits were $1.2 billion, with IntraFi Cash Service® (ICS®) One-Way Sell® deposits totaling $71.8 million.

Q1 was an abnormally strong quarter due to significant post election fundraising by Trump associates. As indicated by the graph below, the $317 Million surge in Q1 deposits is a surprising break from traditional seasonality experienced from 2008 to 2024.

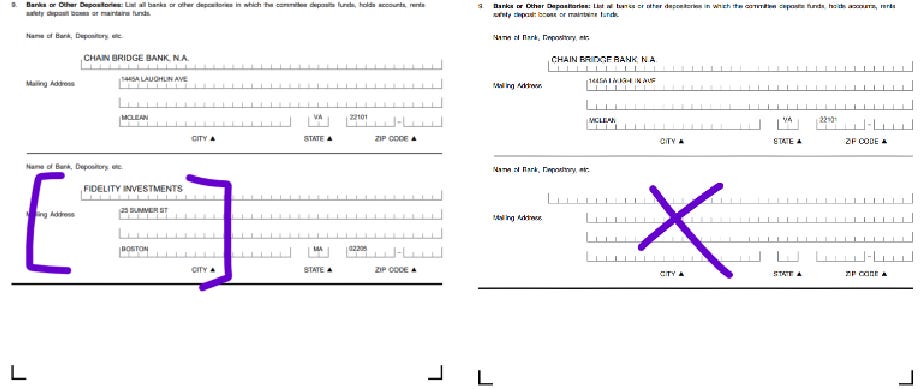

It’s impossible to predict exactly where the quarter-end Political-Related deposits figure ends up for Q2. My initial concern with the sizeable outflows was that it represented customers leaving the bank, but I have confirmed that is not the case. Additionally, if anything, FEC Filings indicate that more and more Trump-affiliated PACs are in fact consolidating their banking business at Chain Bridge. Below is a comparison of Trump’s latest PAC, the Trump 47 Committee, removing Fidelity as a bank in its January 2025 Filing relative to its August 2024 filing.

I also considered the possibility the funds were invested into T-Bills. While this is a possibility, I’d be surprised if it accounted for the entire outflow as Trump-related organizations, and PACs in general, do not do this. Throughout 2024 PACs such as Make American Great Again Inc, which held sizeable cash balances of more than $500 Million, reported nothing in dividend and interest income.

Still, we have to consider the possibility that some of this deposit outflow might be attributable to a PAC or Organization seeking interest income from Treasury Bills. If this were the case, it isn’t something that concerns me too greatly as the funds will inevitably move back into Chain Bridge’s coffers since the operating accounts of all of these organizations are at Chain Bridge, and the money will eventually need to be spent. We also need to contextualize the outflows: they occurred after record breaking Q1 fundraising, and have simply brought deposits back to where they began 2025 at.

Penciling in a sizable $327 Million decline in Q2 Political Deposits (entirely reversing the $317 Million gain in Q1) I arrived at $0.44 in Q2 EPS, which is conservatively lower than Raymond James ($0.49), Hovde ($0.70), and slightly higher than Piper Sandler ($0.39).

Ultimately, I think Q2 earnings aren’t too important as Chain Bridge’s EPS is highly cyclical and inflects upwards the closer we get to election time. Q2 2025 is just a “taste” of what we’ll see in the build up to the 2026 Midterms, and more importantly, the 2028 Presidential Election.

Additionally, regardless of the timing of deposit flows, I think the fundraising energy we saw in Q1 is indicative of the fact the 2026 Midterms and 2028 Presidential Election will be bitter, and flush with cash, which bodes well for Chain Bridge Bank.

If you have any interest in researching further, a list Trump Political Organizations that have operating accounts at Chain Bridge are:

Make America Great Again Inc (Super PAC)

Maga Inc (Super PAC)

Trump Save America (JFC)

Save America PAC (PAC)

Preserve America PAC (Super PAC)

Donald J. Trump for President 2024 (Campaign Committee)

America PAC Texas (Super PAC)

Trump National Committee (JFC)

Trump 47 Committee (PAC)

Source: FEC Filings

Overall Risks:

Chain Bridge is a highly rate sensitive bank. A higher-for-longer environment significantly benefits earnings given the fact most of their deposits are zero cost. A sudden recession wouldn’t impact Chain Bridge in the sense of asset quality as it would most regional banks, but it would certainly impact them in terms of interest income due to resulting rate cuts. In my model three cuts are implied by Q1 2026, which seems to be in line with what the futures markets has implied. If you factor in 6 cuts by the end of 2026, 2026 EPS can get as low as $2.40, which would put Chain Bridge around 11x 2026 Earnings.

There is also significant political risk. Chain Bridge should be considered “The Bank of Trump”. Reckless policy and resulting poor fundraising would lead to lower average balance, reducing net interest income.

Additionally, it is not inconceivable that President Trump (who already sells his own perfume, watches, and meme coins) starts his own bank and moves his PACs there.

Although it sounds crazy, in this market it’s beneficial to imagine what the most insane outcome can do to your portfolio. Chain Bridge has significant Tangible Book Value which I believe acts as a put on this trade, limiting downside to $23. Unlike speculative fintech, or volatile insurers with intangible value, Chain Bridge’s $23 in book value represents cold hard cash and high quality loans. If a sudden departure of political customers rendered the bank unable to turn a profit, I have no doubt the highly incentivized owners would simply sell the bank at or slightly above book value to interested buyers, rather than run it into the ground.

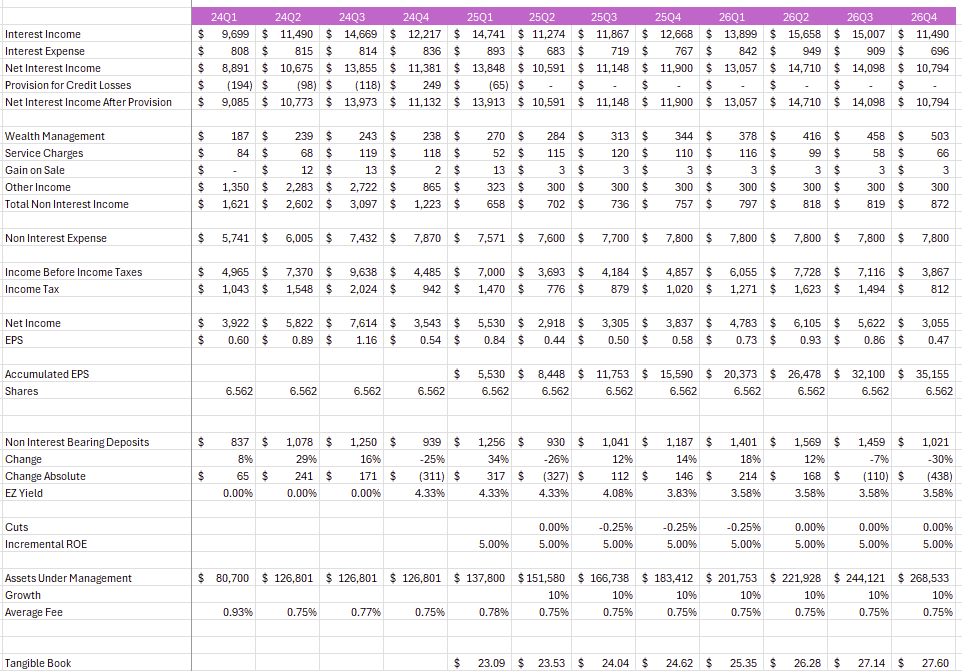

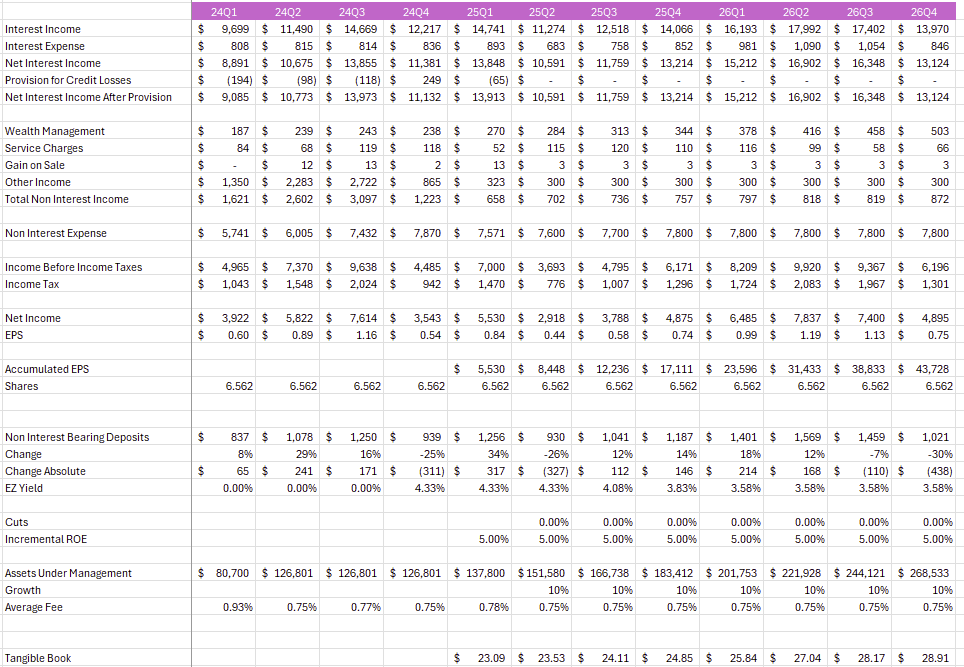

Model:

Assuming 3 rate cuts from Q3 2025 through Q1 2026, I arrive at 2025 EPS of $2.38 and 2026 EPS of $2.98.

Assuming no rate cuts I arrive at 2025 EPS of $2.61 and 2026 EPS of $4.08.

Position / Trading Levels:

I am long 10,000 shares @ $25.80

I think a fair price target for CBNA 0.00%↑ is somewhere in the $28-$30 range. With Chain Bridge’s differentiated model, exposure to higher-for-longer, and long term secular tailwinds behind money in politics I think a more optimistic industry-like multiple such as 1.25x-1.35x to Tangible Book (still a discount to the industry) or 10x-12x 4 Year Cycle Earnings ($28.90 - $31.20) represents an attainable target.

Nonetheless, it is extremely important to exercise discipline on your entry points for Banking and Insurance names. Unlike technology names where you can rely on growth to bail you out of an expensive entry level over the “long term”, you don’t have that going for you with financials. As a result, I believe it makes sense to consider a starter position around $26.63, (15% over tangible book), and leave yourself flexibility to get active should a more favorable setup arise.

At $26.63 Chain Bridge benefits from obvious tailwinds such as the Russell 2000 reconstitution tailwind and a sub-industry multiple despite its strong growth and minimal balance sheet risk, but it has also run up approximately 9% in the last 20 sessions which lessens the risk-to-reward relative to where it was at the beginning of May. To take advantage of this, I’ve left outstanding GTC orders to add to my position in the $25 - $26 range, which represents a lower 8-12% Premium to Tangible Book.

Should Chain Bridge trade in the $23 - $24 Range without any directly applicable news, I plan on adding heavily. I think it would be an excellent deal there, and I am still kicking myself for not publishing my article back then!

I wish I could bang the table with an outlandishly aggressive price target, but I like to keep my expectations reasonable. Overall, Chain Bridge is an above-average bank that has significantly minimized the traditional risks that impact most peers, and over the long run I think it will outperform the Regional Bank Index. I think 10-15% upside is present at the current price, and that the risk-to-reward sweetens significantly should the stock trade down between $25 to $26 in the near future.