Double Vision?

Getting the Most Out of Your Money With Dual Class Shares - Samsung, Taiwan Semi, and a Niche Financials Name at 6.5x Earnings and a 4.8% Dividend

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

You’re so cute, I wish there were two of you.

What if there were?

In the United States, many large publicly traded companies have dual classes of listed shares, all of which trade at a relatively tight spread to each other.

Google Class C (GOOG US Equity - $290.59) vs Google Class A (GOOGL US Equity - $290.10), Zillow Class C (Z US Equity - $73.05) vs Zillow Class A (ZG US Equity - $70.82), FOX Class C (FOX US Equity - $60.05) vs FOX Class A (FOXA US Equity - $66.53), in pretty much every instance even including Malone tracking empire (Liberty, Formula One, Atlanta Braves), different classes of shares tend to trade within 10% of each other.

There are a few global instances where this isn’t the case, and interestingly enough two of them belong to today’s AI darlings. There are various reasons why these discounts won’t close (one is a non-freely convertible ADR), but if you are a long-term investor, a believer in AI, and have an Interactive Brokers account, here are a few ways you can maximize “bang for your buck”.

1. Long Samsung Electronics Preferred (SMSD LI Equity) instead of Samsung Electronics Common (SMSN LI Equity)

Contrary to popular belief, you can buy Samsung if you are American, just not in America. More on that later.

Samsung has two classes of shares, the Common - 005930 KS Equity (88% of shares outstanding, $3.1 Billion USD daily volume) and the Preferred - 005935 KS Equity (12% of shares outstanding, $200 Million USD daily volume).

In the United States, Preferred Stock and Common Stock differ meaningfully. Preferred Stock usually carries no voting rights and receives fixed (occasionally floating) dividends. In the event of bankruptcy, Preferred Stock stands higher up on the capital structure and are entitled to liquidation payments prior to Common stockholders.

This isn’t the case in Korea.

Samsung Common and Samsung Preferred are almost identical. The Preferred Stock carries no voting rights, but the Common and Preferred have the same exact claim on the company. The only minor difference is that due to Korea Securities Law Samsung must pay a higher dividend on Preferred Stock than Common Stock. In 2024 Samsung paid a dividend of 1,447 Won to Preferred holders vs 1,446 Won to the Common, and in 2025 paid a dividend of 1,473 Won to Preferred holders vs 1,472 Won to the Common. As you can see, the difference in dividends is just a token amount of 1 Won.

Given the slightly higher dividend, you’d assume the Preferred would trade somewhat close to the Common, but that is not the case. In fact, it trades at a 24% discount. Why? The elephant in the room: passive ownership via index inclusion.

Only Samsung’s Common Stock is allowed into indexes such as the benchmark Kospi 50, Kospi 200, and MSCI Korea. As a result, as investors hungry for Korean equities and AI related names plunge into the Kospi and MSCI Korea, Samsung Common has benefitted from a massive passive tailwind, while Samsung Preferred has experienced no benefit at all. As a result of this passive buying differential, the Common Shares have outperformed the Preferred by 15% year to date, and trade at the highest premium in 5 years, 31%.

I’m not calling for a widowmaker trade of Long the Preferred and Short the Common – if you want to shove a fork in a toaster there are easier ways such as owning a value ETF, being an energy investor, or adhering to red lights as a cyclist in New York City (you will be rear-ended).

What I am saying, however, is that if you are a long term believer in Samsung, the Preferred is certainly looking attractive.

The Common is trading at a forward valuation of 12x 2026 earnings and a dividend yield of 1.43%, while the Preferred is trading at 9x 2026 earnings and a dividend yield of 1.87%. Samsung at 9x earnings? Don’t mind if I do.

While you can’t trade the Common and Preferred directly on the Korean Stock Exchange, luckily both are listed as GDRs (Global Depository Receipts) on the LSE International Order Book under the tickers SMSN and SMSD, and trade in US Dollars. The volume in these GDRs is notably lower than on the native Korean Stock Exchange (about $35 Million for SMSN and $5 Million for SMSD), but there is still sufficient liquidity to buy a handful.

I’m not expecting this valuation differential to close anytime soon as the passive flows into Korea continue, but if you want some Samsung exposure, why not consider the Preferred at 9x earnings and get an extra 0.44% in dividends? Food for thought.

2. Long Taiwan Semiconductor (2330 TW Equity) instead of Taiwan Semiconductor ADR (TSM US Equity)

Taiwan Semiconductor is unique not just for its dominance in chip fabrication, but also for having one of the world’s only one-way ADRs. Historically, local Taiwan semiconductor shares (2330 TW Equity) have been convertible in small quantities into the ADR (TSM US Equity), but the ADRs have never been convertible back into local shares.

Currently, 21% of outstanding shares are ADRs, and any additional conversion of local shares to ADRs has to be expressly approved by the company. ADR conversions haven’t occurred for years, and as a result American tech investors hungry for chip exposure compete for a tiny slice of the pie, and the price differential between local shares and the ADR has grown larger.

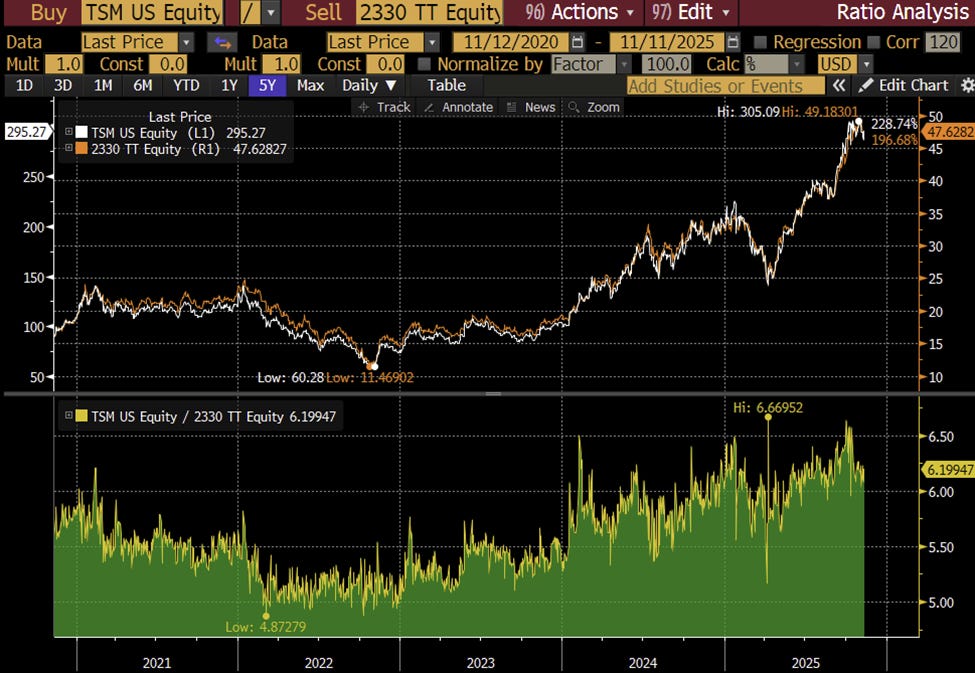

This year alone, Taiwan Semiconductor’s ADR (TSM US Equity) has outperformed the native listing by 4%, and the differential between the ADR and the Native Listing has risen to a record 30% before retreating to 24% this month.

(Note 1 share of TSM US Equity = 5 Shares of 2330 TW Equity, so a ratio of 6.2 means the ADR is trading at a 24% Premium to the local listing).

Once again, I am not calling for a widowmaker trade of Long 2330 TW Equity Short TSM US Equity Trade.

However, if you are a long-term believer in Taiwan Semiconductor, why not get a larger slice of the pie for the same amount of cash?

IBKR’s currency conversion is seamless (a few basis points), and while you do need to pay a 0.3% Financial Transaction tax when you sell and 0.15% in annual custody fees, the local listing trades at 20x forward earnings with a dividend yield of 1.30%, while the ADR trades at 24x earnings and a dividend yield of 0.98%. The lower valuation is attractive, the elevated dividend yield covers expenses, and you stand to gain from superior returns if the differential ever narrows to the historical range of 10% - 15%.

It’s also important to note tax treatment for dividends from ADRs and the local listing is the same for US residents. One concern you may have is that if China ever invades Taiwan, treatment will be different for ADRs vs local shares, but I can assure if China indeed invades Taiwan, what happens to your local shares will be the least of your concerns once you are on the front lines.

3. Miscellaneous – SK Hynix GDR

While the Hynix ADR in the United States doesn’t trade (aside from a guy bidding 100,000 shares at a penny), you can still own SK Hynix as an American. SK Hynix has a Global Depository Receipt listed on the Frankfurt Stock Exchange under the symbol HY9H that trades in EUR. Since the GDRs are freely convertible, just like SMSN and SMSD, it tends to trade close to the local listing.

Hynix has had an incredible run up this year, but I still find it interesting at 7x 2026 earnings. Furthermore, recent rumors that Hynix is contemplating a sponsored US ADR get me even more interested – a sponsored US ADR would enable a massive increase in passive ownership.

Korea itself is rapidly becoming investor friendly. The President literally promised to “double the Kospi”, and regulatory crackdowns on abusive related party transactions, and a government push for companies to return capital (similar to the Tokyo Stock Exchange’s shame list of companies who refuse to provide clear-cut capital return guidelines) have driven the stock market to record highs.

Hynix and Samsung moving forward with sponsored US ADRs would be a genius move. Imagine this from their perspective, pump your own markets 100% and then when things get shaky, list your two largest companies on the Nasdaq and watch the American passive money waltz on in. If Pinduoduo can be in the Nasdaq 100, so can Hynix (if they follow through with an ADR and list on Nasdaq).

The purpose of this isn’t to slam the table for Hynix as a buy, but rather, to let you know it is purchasable.

Finally, bonus round.