Earnings Updates and A Software Shot in the Dark

Value in the Wreckage?

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

Earnings

Two names we discussed, Comfort Systems FIX 0.00%↑ and Ategrity Specialty Insurance ASIC 0.00%↑ released Q4 earnings yesterday.

Comfort Systems, a leading provider of mechanical, electrical, plumbing, and HVAC Systems, reported blowout results: $9.37 in earnings per share versus the $6.76 consensus and $2.646 Billion in Revenue vs the $2.337 Billion consensus. Backlog grew a record $2.56 Billion to $10.1 Billion as demand surged from existing clients and new data center projects across the board. Comfort Systems remains a top infrastructure pick of mine, along with IES Holdings IESC 0.00%↑, Powell Industries POWL 0.00%↑ , Sterling Infrastructure STRL 0.00%↑ , and Power Solutions International PSIX 0.00%↑ . While Comfort System’s blowout results likely captivated everyone’s attention, I think Ategrity Specialty’s quiet beat stole the show.

Insurance has been a chaotic sector this year. Declining Global P&C Rates and intensifying competition in E&S (Excess and Surplus Lines) and Reinsurance has triggered a broad sell-off. Interestingly, many small cap names posses the agility to dodge overall rough market conditions have been punished the most, as investors rally around “large-cap quality” and ferociously buy-the-dip on “the generals”, leaving smaller names out to dry. I think Ategrity has been mistakenly left behind.

Ategrity Specialty is (as the name implies) a specialty insurer focused on low ticket Excess and Surplus lines for small and medium sized businesses across the United States. Ategrity distinguishes itself via a concentration in Casualty (liability), and its brand new technology stack has enabled it to reduce turnaround times despite overall policy pipeline growth of 250% in 2025. Its fast turnaround times and focus on traditionally underserved small businesses and states like North Dakota, Ohio, and Nebraska has helped it steadily poach market share from peers, with 2025 gross written premium jumping 30%, nearly 20% above the broader E&S industry.

Based on early 2026 monthly E&S Stamping data published from states such as Florida, it’s clear Ategrity’s growth and outperformance is showing no signs of slowing. Ategrity’s January 2026 Premium in Florida is up 14% YOY to $7.06 Million , while the more well-known E&S giant Kinsale Capital Group is down 6% YOY from $28.9 Million to $26.9 Million.

Despite excellent financial performance and clear growth ahead, Ategrity has languished the past few months due to three primary reasons: concerns about its reserves, jitters over the E&S market, and overall low liquidity. What really caught my eye yesterday is the fact Ategrity put all three concerns to bed.

Unlike previous quarters, Ategrity showed no prior year development:

We again had no prior year development. Catastrophic losses were 3.2% of net earned premiums, down from 3.7% last year due to very few catastrophe events in the fourth quarter. Our reserves are in a very strong position overall, both in property and casualty. You heard Chris mention in the prepared remarks that the early indicators for the recent years are coming in very strong. And so we are highly confident in our reserves there.

Of course, every insurance executive will want to state their reserves are adequate, but several quarters of “no bad news” on the reserve front is enough to be “good news” given how downbeat overall sentiment was.

Ategrity also affirmed it is still in “growth mode”, with internal projects such as “Operation Heartland”, a focus on “flyover states”, and new brokerage packages in Florida and New England are projected to help further increase market share.

Yes. So there’s two parts to Project Heartland. There’s an appointment component, adding more partners, and we are nearing the end of that phase. It’s more about getting more wallet share from partners. So we’re just at the beginning of that phase.

That is a, we feel like the investments we have made in the Midwest, not just in distribution, but in terms of developing products and really making a unique play in our verticals, is really what’s allowing us to stand out. So we see a huge runway for growth.

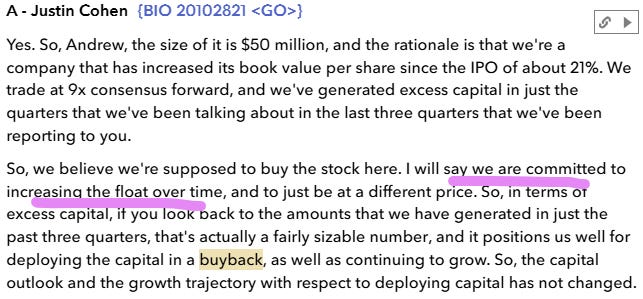

Lastly, and perhaps most importantly, Ategrity is taking steps to address the undervaluation of the stock.

Ategrity is tightly-held, founder Stuart Zimmer of Zimmer Partners owns 38 Million shares, ($760 Million, roughly 80% of shares outstanding). Due to the low overall float, liquidity has been thin and market activity has been highly choppy, dissuading new Institutional Investors and leading many June 2025 IPO buyers to throw in the towel.

Yesterday, Ategrity announced a new $50 Million buyback, which might seem small relative to the $960 Million Market Cap but once you realize less than $200 Million of shares are floating, the scale of the buyback becomes apparent.

From the transcript, it seems clear that they are saying one day Stuart Zimmer might want to sell shares, but only at a good price and that given the valuation Ategrity is trading at, they will be happy to repurchase shares until a premium valuation is hit. Given Stuart Zimmer himself was purchasing shares in the high 20s and 19s, it seems apparent that the buyback will provide significant support where Ategrity is currently trading, and that the risk of a secondary offering is minimal at the current valuation. Perhaps a concern at $24 - $26, but doubtful at $20.

Ategrity’s $0.51 report yesterday set an excellent tone for 2026: underwriting income tripled from $5.9 Million in 2024 to $15.4 Million in 2025, and the company clearly sees its shares as undervalued. While I am not expecting a triple for 2026, it’s apparent Ategrity is a scale story: now that they have their foot in the door via nearly 600 broker partners, new growth is highly accretive to the bottom line as investments in AI and technology keep underwriting costs relatively flat.

I think Ategrity found itself in the wrong place at the wrong time as investors mercilessly dumped insurance stocks and the IPO became considered as a “flop” Yesterday’s earnings report provided a highly important “reset”, and with the stock now trading at just 11x 2026 consensus earnings of $1.83 (frankly, I think Ategrity is within striking distance of $1.90 to $1.95) paired with a buyback program that amounts to 25% of the float, I think the narrative surrounding Ategrity is about to flip: Ategrity is drastically undervalued relative to peers and the broader market, and is perhaps one of the only insurance “growth” stories for 2026.

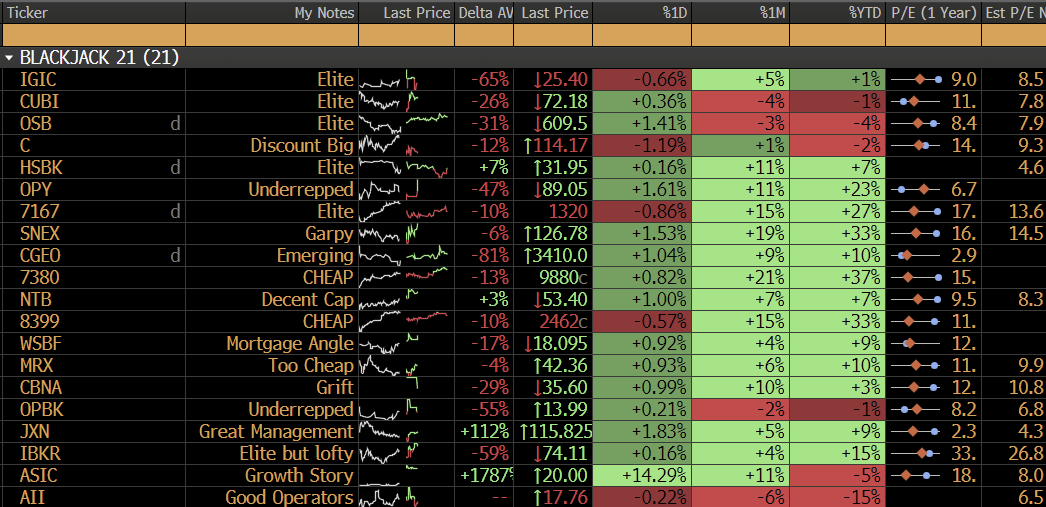

With Specialty Peers such as Palomar and Kinsale all trading in the 14x - 18x range, I think Ategrity is simply too cheap to ignore at 11x given an industry-leading growth profile and highly-aligned insiders. Given the excellent report, I have increased my position to 2% of my portfolio, and added Ategrity to my global basket of high conviction banks and insurers.

A Software Shot in the Dark

Up until Tuesday, I had zero software names in my portfolio. Now, I have one.

Old habits truly do die hard, I’ve traded Bumble on and off since 2024 and I have once again bought a speculative position. I’ll keep this one brief since Bumble is pretty obviously a melting ice-cube and a loser, but I also think there is a price for everything.

Bumble currently trades at 4x 2026 GAAP projected EPS of $0.75. Users are fleeing (I anticipate losses of another 150k in Q4) and the company is priced for terminal decline. Not everything is as it seems, though.

A good chunk of Bumble’s $1.15 Billion in liabilities was a complex $399 Million Tax Receivable Liability, cash due to Blackstone and Bumble Founders due to complications surrounding a reorganization of partnership shares into C-corp shares. Subsequent to the quarter end, Bumble was able to “buy out” this liability for $186 Million in cash at roughly 44 cents on the dollar, reducing overall liabilities to less than $800 Million (and its cash balance to $120 Million). Looks like Blackstone wanted to “cash out”, given they’ve also filed Form 144’s to liquidate their shares.

Given Bumble’s history of perpetual disappointment I would by no means qualify management as competent (stock is worth less than 5% of what it was when it IPO’ed) but given current cash flow it looks as though Bumble would have to intentionally try to run the company into the ground. One thing that caught my eye last quarter was the impact of the Apple App Store ruling.

In April 2025, Judge Yvonne Gonzalez Rogers ruled that Apple willfully violated a 2021 injunction in the Epic v. Apple case, and banned Apple from charging any commission on purchases made through external links in iOS apps. Although this decision has been partially walked back after an appeals court ruled “Apple can charge a reasonable fee” for external payments (links that divert to Stripe, etc), this reasonable fee has not yet been determined.

As a result, there is a goldilocks period where Apps are temporarily able to redirect existing clients to external payment methods such as Stripe, and entirely cut out the 30% due to Apple. For names like Match and Bumble, they are still charging the same price on both Apple-native and external payments, but it is obvious that any customer switched to an external payment rail, even if enticed with a “one month freebie” or a discounted annual rate via a marketing deal, is vastly more profitable when Stripe’s cut is 5%, versus the app-store at 30%.

The earnings call itself hinted at this:

Okay. So, no, I haven’t seen the details, so I don’t have any insight to share there. I can comment briefly on, sort of our direct billing initiatives. As you might expect, we, as soon as permitted, we set up alternative payments, and we’ve been testing those strategies throughout Q3, and we’ll continue to do that in Q4. You saw in our cost of sales a meaningful improvement in Q3, and we would expect to continue to, while we will, refine strategies around alternative billing throughout Q4, we’d still expect that benefit to persist into Q4, and we should have a full quarter effect of cost of revenue benefits.

Even if the appeals court enforces a “reasonable fee” that is levied on external payment methods established during this grace period, it’s obvious that the net effect will still be positive for Bumble provided they are able to switch users in Q4 and Q1. A mere 20% move of users from a 30% commission payments rail, to a 5% commission payments rail, could significantly boost earnings and cash flow, yet analyst consensus for Q4 and Q1 does not seem to price in the possibility at all.

Could Bumble blow up? Certainly, although I think it might be the first company in history to “marketing spend” itself into bankruptcy. The possibilities for cost cuts are endless: $119 Million in R&D, $189 Million in Marketing, $141 Million in G&A.

The Bumble founders still have decent equity in the company, roughly 25 Million shares, a little more than 15% of the company. I think after this epic implosion, they will be incentivized to enact cost cuts across the board to save their 8 figure salaries and equity stake. A mere 10% reduction in R&D and G&A (which seems possible given Claude Code and the implementation of AI) could add nearly 20 cents in earnings per share.

I get the Software-pocalypse, a lot of new tools seem to pose an existential threat to many businesses. I think the differentiator here, however, is Bumble’s edge isn’t the matching of users, it’s the users themselves.

Even if you had 1,000 upstart dating apps that could match regional bank lovers and SK Hynix fans with eachother at pinpoint accuracy, it would only really work if you had hundreds of thousands of users on the app. While Hinge is likely the only “growth” story in dating apps (Match Group also seems cheap to me), Hinge, Tinder, and Bumble still have massive user bases, and I think at the current valuation Bumble has several options at its disposal to prevent a total implosion and start returning value to shareholders.

Given Bumble’s history of implosion, however (not even kidding they usually drop 30% on each earnings report), caution is warranted, so I’ve sized the position very small at 0.50% of my portfolio. At 0.50% it’s not large enough to cause havoc, but if you sprinkle in a few Chinese AI names like Minimax, or Georgian Discount -to-NAV setups like CGEO, they can really add torque to returns while being isolated enough to eliminate catastrophic implosion risk, a 60% drop on a 0.50% stinks, but isn’t the end of the world.

Overall, I am way more confident in Ategrity Specialty over the next 10 years than Bumble, but there is a price for everything and I think Bumble below $3 a share may warrant a small, highly speculative position. At 4x 2026 earnings, plenty can go (and has been going) wrong, but with expectations so low (just like the Ategrity setup) we only need a little bit to go right for things to work out.

Next weekend, I will be posting a Review of my US Portfolio. Until then, have a good one. There is nothing below this paywall but I can’t figure out how to publish without one.