February 3 2026

AI's Impact on Software Lending, Bank Earnings, and Buying the Infrastructure and Insurance Dip

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

They told us 2026 would be the “Golden Age”. What they meant, perhaps, was the “Golden Age of Disruption”.

This piece is a departure from the usual, a rant about AI, followed by earnings updates from Portfolio Holdings, and finally two names I have been adding to recently in Infrastructure and Insurance.

It’s not hard to see how fast AI is evolving. Three years ago, it was a fun gimmick: videos of Will Smith munching on spaghetti and screenshots of people trying to “trick” ChatGPT into answering ridiculous questions. Now, we have models generating 3-D Worlds, production class videos, custom dashboards that may have taken weeks or months to build, and as of yesterday, reviewing and analyzing legal contracts. Things have moved, quickly.

Everyone seems to be hard at work guessing when the Memory and Storage cycle tops, and there’s no doubt given the recent run of Hynix, Samsung, Micron, Western Digital, and Kioxia that there is bound to be another -10% or -15% day and everyone will quickly declare it to be “over” (we had that last week for Western Digital and Kioxia, and Monday for the Kospi, Samsung, and Hynix). But what if the cycle lasts longer than a mere year or two? What if the pace of new AI features, model development, and data generation continues to accelerate. Do you think that is reflected in the price of Hynix at 6x 2026 earnings, or Samsung Preferred Shares at 6.5x 2026 earnings? Personally, I don’t believe so, which is why I own them.

I think we are just beginning to see AI features in daily life. Investment Bankers are using Claude, Shortcut, among others, to generate rough models in record time. Companies like Oura are using agentic AI to entirely handle customer service. Angie’s List is slashing their engineering and marketing department in half as productivity explodes higher. Digital Banks like Mercury now let you upload invoices that will automatically be processed, paid, and it sends a nice confirmation email to the company’s billing email address as well.

It’s not hard to use a bit of imagination to see where things are going.

What’s next?

Tax Software that can connect to your expense accounts and brokers, classify transactions, and have a return prepared quickly? Microsoft “revitalizes” Copilot, and all of the sudden you can just hit the Start Menu, ask it to organize your Downloads Folder, send a few emails, and purchase something online? Insurance software that can communicate with new home buyers and package together Inspection Reports and questionnaires, saving agents countless hours?

All of this sounds far-fetched now, and even if it is implemented you are right to assume the road will be bumpy and littered with errors, but give it 5 years to a decade and I have a feeling you will see all of these new products emerge.

The question is, how to play it, and what to buy?

I’ll be blunt, I don’t know.

I’ve sold my Nvidia shares and Powerchip shares, and I own a basket of Memory and Storage names (Samsung Preferred, Hynix, Western Digital, Micron, and Kioxia) as well as AI “Buildout” Names (Comfort Systems - probably expensive here, Power Solutions International, Powell Systems, IES Holdings). Is there still upside? Hopefully.

What I feel more confident in, however, is simply steering my Portfolio clear of setups with limited upside and decent downside (had to close FRSH out today). One group fits this in particular: “Direct Lending Funds” and BDCs.

I think when you take a look at someone like Adobe or Thomson Reuters (I’m no longer short ADBE), it’s easy to argue the moves are not based on short-term fundamental implications (both are reporting decent results), but rather shifting sentiment regarding the terminal value of their businesses. What will happen in 5 or 10 years?

While both names are fine long-term (from a credit perspective), imagine how the lenders to smaller software firms are feeling as they watch the equity of Large Cap software names implode.

The allure of Private Credit is that investment marks don’t change day-to-day. But with software names imploding left and right, do you really think the value of these loans has remained stable? Furthermore, do you think the guys extending credit at SOFR + 5.00% will be happy to do it again when these loans mature? I think the more likely answer is: They’re going to want their money back.

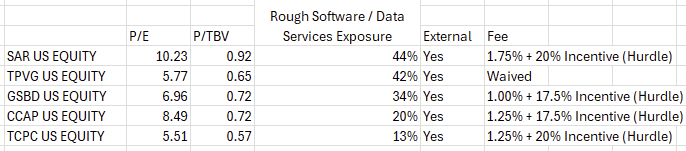

I love buying financials names at a discount, but I am entirely steering clear of Private Credit Funds and BDC’s specializing in software. I think in the coming years, their concentration in “Software Lending” will no longer be considered an asset, but rather a liability.

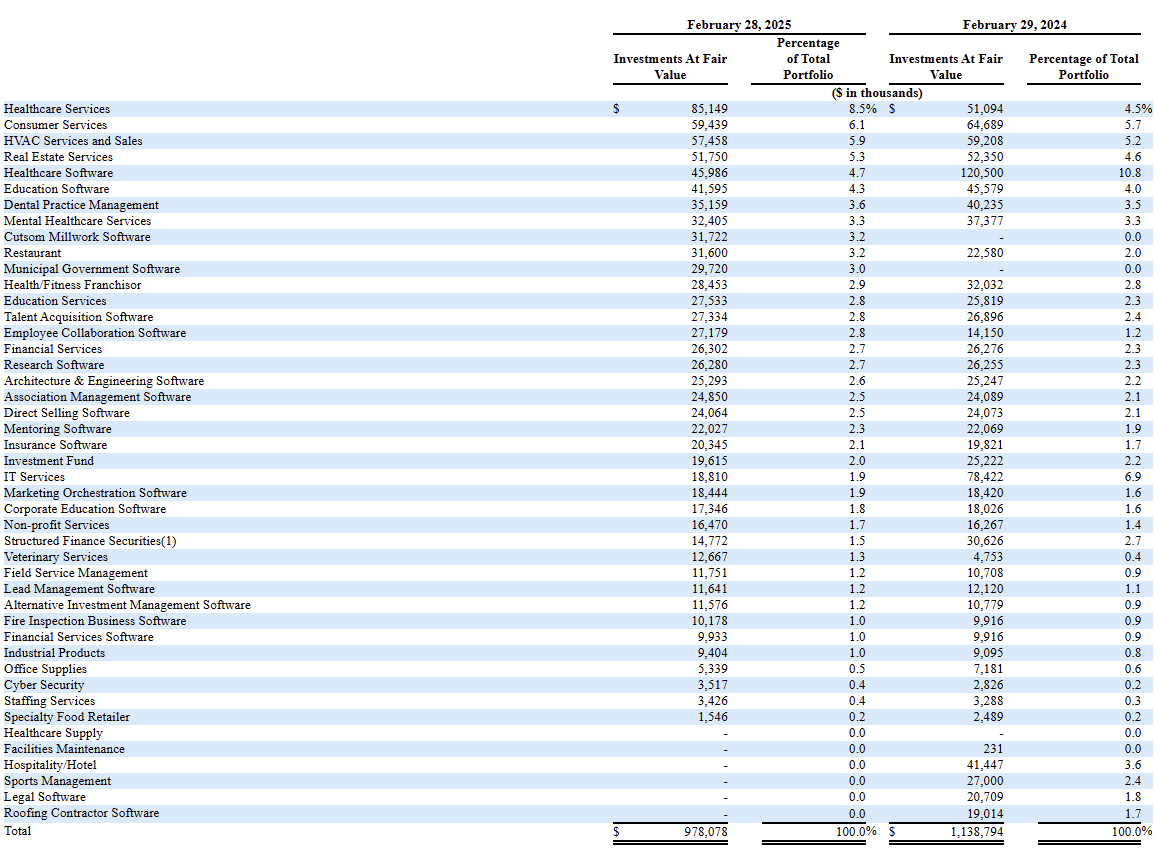

Take Saratoga Investment Corp as an example. It’s a name I used to own, and at first glance, it looks like a winner. A historical return of 16.2% since inception versus 15.7% on the S&P 500. Trades around 10x earnings, 0.92x Tangible Book, and a dividend yield of 12%. I don’t think anyone would argue it is an “expensive” name.

Once I take a look at the Portfolio however, things get less positive. Nearly 44% of the Portfolio is concentrated in software. Real Estate Software, Healthcare Software, Education Software, the list goes on.

Another publicly traded credit name, Blackrock TCPC (TCPC), recently recorded a 19% drop in Net Asset Value, driven by declines across E-Commerce (SellerX) and Software (Edementum) names, among others. Private Credit giants such as Blue Owl Capital Corp, Ares, and Apollo are down nearly 20% as people begin to worry about Investment Gone Bad.

My point is, with the Asset Managers themselves sounding the alarm, why take a risk by bottom fishing BDC’s or Publicly Traded Lending vehicles with sizeable Software Lending exposure?

At best, you have limited upside to Tangible Book Value (I don’t anticipate any of these names trading above Book Value due to the high management fees charged), and at worst, you are stuck with Portfolios with greater than 10% software lending exposure coupled with high fees, in an era where Large Cap Software Equities are getting halved left and right.

I get asked about “bottom fishing” BDC’s nearly every day, and I wanted to answer it clearly: I’m steering clear.

I believe that by merely staying away from falling knives exposed to AI, and instead adding a bit of exposure to names that stand to benefit significantly from the trend (such as Google, Samsung, Hynix, etc), you are doing yourself a favor.

Earnings

Several Portfolio Holdings reported earnings last week: OPY, CBNA, WSBF, NECB, and MBIN.

OPY - Oppenheimer stole the show last week with its strongest quarter since 2022: $6.51 in Diluted Earnings.

I really like Oppenheimer’s unique structure of a very stable Wealth Management business, coupled with a Capital Markets division that provides significant right-tail optionality when Small Caps and Biotech do well. Operating Income from the Capital Markets segment surged from a loss of $5 Million in 2024 Q4, to a profit of $52 Million in 2025 Q4. While I am not expecting similar results for 2026 Q1, given the strength of Small Caps, Biotech, elevated Equity Issuance, and record market valuations, I think Oppenheimer is firing on all cylinders, and is in a strong position to beat 2025’s $13.04 in EPS.

Unlike Banks and Insurers who come with significant left-tail risk when asset quality declines or catastrophes occur, Oppenheimer is a fee-based business, and they are free to do with their profits as they please. They are sitting on a clean balance sheet with no debt, and recently announced a $1 Special Dividend in December. While the name is choppy day-to-day, long-term I believe Oppenheimer will continue to be an outperformer, and that record results and a bit of time under the spotlight will demonstrate the compelling value it is generating.

CBNA - Chain Bridge reported earnings of $0.81, a decent beat relative to the consensus of $0.75. Perhaps most encouragingly, Chain Bridge recorded nearly $400 Million of deposit inflows in the quarter for GOP-linked Political Action Committees ($200 Million of which were diverted to other banks via the Intrafi network).

As a reminder, Chain Bridge is a highly unique bank. It has minimal credit risk as it simply does not lend out its Non-Interest bearing deposits, instead parking them in Treasury Bills and reserves. Chain Bridge is a beneficiary of higher for longer, and balances out other rates down names in my Portfolio (such as OP Bancorp and Waterstone Financial). I have a feeling this year’s Midterms will be vicious, and in an age where cash continues to pour into politics, Chain Bridge represents a one the only ways to “own the house”.

NECB – Northeast Community Bancorp reported $0.79, a bit lower than the consensus of $0.82. Asset quality remains pristine with no non-performing loans. NECB is beneficiary of higher interest rates, and stands to gain (just as CBNA does) from the prospect of reduced rate cuts this year. What I like most about NECB’s report is 40,000 shares repurchased below Tangible Book around $23 a share. With Tangible Book Value now upwards of $25.30 a share, I think entries in the high 23’s and low 24’s provide compelling value, you are getting the stock just under 8x earnings, and the share repurchase program is likely to provide support in the low 22’s, should it trade down there.

WSBF – Very strong quarter at $0.44. No estimates, but I am pleased with the results. Net Interest Income continues to grow steadily, and the mortgage segment posted the strongest results in years. The company still trades at nearly $2 discount to book, and repurchased another 140,000 shares to take advantage of this. I think the stock is well on its way to make $2 a share this year, which means it is currently trading at just 8.5x earnings, a very compelling valuation given the upwards optionality of the mortgage underwriting segment. Ultimately, I think the mortgage segment is worth a significant premium to book, and that WSBF will one day be acquired by someone looking to grow their own mortgage business. While WSBF’s mortgage segment is what most people care about, Net Interest Income has grown from $13.7 million in Q2, to $14.7 million in Q3, to $15.5 million in Q4. This steady improvement, as a result of declining deposit costs, will continue regardless of activity in the mortgage segment. WSBF still trades slightly below book value and closely comparable peers, and if mortgage activity increases, I think WSBF is within striking distance of $2.00 a share in earnings this year.

MBIN – Great results, and asset quality improved significantly. EPS $1.28 beat the consensus of $0.94 (although the $1.28 figure includes some one-time tax impacts). What was most impressive was the announcement of a new $100 Million share repurchase program, which should help change sentiment now that MBIN is back in “capital return” mode. Still, MBIN at 6x earnings was a bargain, but at roughly 8x I’m not so sure given lingering credit issues. I think the upside and downside are fairly balanced here at $42 a share.

Now, time for two new trades.