Identifying, Structuring, and Sizing a Value Trade

A 4-Step Framework to Separate Value Trades from Value Traps

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

Understanding Context

A “Value Trap” Checklist

Putting It Together - A Real Life Trade

Context.

Context is one of the most important factors an investor needs to understand. It’s the reason why a value-driven framework can deliver outstanding results for certain stocks while having absolutely no bearing on others.

Context is more than just being aware of current events, peers, and pertinent financials; it’s about knowing the tendencies, positioning, and thesis held by a “crowd” that trades a stock. Take Tesla’s 15% drop on June 5th as an example. Was the brief Twitter war between Trump and Elon worth an immediate $152 Billion plunge in market cap (roughly 20 times Tesla’s 2024 Net Income)? Probably not if you were applying a value-driven framework to the news, but you have to understand context: Elon’s proximity to Trump was the driving factor behind the November to May rally, so to the Tesla bulls the 15 minute Twitter war was devastating news.

Understanding context can help you structure asymmetric trades. My "Welcome, Mr. Mayor" basket was engineered to pay off if Mamdani won, knowing that there are few, if any, regional banks bulls. If Cuomo won, do you think the average institutional trader would’ve been excited to purchase Regional Banks with NYC Rent Stabilized Exposure? Of course not, no one likes these banks anyways, and for good reason - they’re largely losers. On the other hand, if Mamdani won, would institutional traders + the average Joe who happened to ChatGpt “Give me a list of 5 Banks with high NYC Rent Stabilized Lending Exposure” at 9:25 make a beeline to dump Flagstar Bank at the open? Of course they would, which is exactly what ended up happening (I've since covered).

My point is, before applying a fundamentals-based framework to a position or a long short pair, apprise yourself of current news, price action, and ask yourself “what does the crowd who trades this stock really care about?” If what they care about is unrelated to your fundamental analysis, you’re essentially just playing craps with a position.

Context is also about understanding yourself, your strengths and weaknesses. As a Retail Investor you’re at an informational disadvantage to Institutional Investors. Anyone with a Bloomberg Terminal gets the news a minute before you do, those with a large broker network might learn of large buyers or sellers and adjust their trading accordingly, and participants in a bank sponsored “1-on-1” meeting might pick up on some pertinent information from management.

Does this mean investing is hopeless? Of course not.

Retail Investors have a tremendous edge that trumps the informational disadvantage: execution. Payment for Order Flow Brokerages like Fidelity, Schwab, and Etrade route their flow to Market Makers such as Citadel, Jane Street, and G1 Execution Services, who are happy to take the opposite end of your trades since in general, they are trading against noise traders. What this means is retail order flow rarely hits the exchange and thus doesn’t impact the price (move the bid or ask).

While the usual losers love to blame Citadel or Virtu for their losses, they fail to realize the markets are actually rigged in your favor provided you have a diligent, fundamentals-based approach. If you have conviction (and enough cash), you can “pick your spots” and get in and out of small caps at astoundingly attractive prices, something Institutional Investors simply cannot do - which is why many of them don’t pay attention to small caps - it simply isn’t worth their time.

It’s still the Wild West in much of small cap land. A massive chunk of $100 M - $1 B names lack substantial equity research coverage and there is still near “free” money to be made by diligently reading news articles or calculating EPS based off a simple earnings pre-release (Kingstone). You’d assume opportunities like this wouldn’t exist in 2025, but they do, and occur on a near weekly basis.

While a small market cap is by no means indicative of a promising investment, I think you’re significantly more likely to find a gem where no one is looking. But with so many small caps optically cheap at first glance, it’s vital to be able to distinguish potential winners from perennial value traps. Here is my simple four rule framework on how to separate the value trades from the value traps.

The Approach.

It doesn’t take a genius to set a screener for names under 10x earnings or half of tangible book. It’s one thing to be purchasing cheap because it’s cheap, it’s another to be purchasing “a turnaround story at a deep value multiple”.

See what I did there? Even saying it sounds better than “I bought it because it’s cheap”, and that’s because the best investments have a clear, convincing story behind them.

There are four factors I pay attention to when reviewing screening results and separating winners from total value traps:

Quality of the Business and Consistency of Earnings

Insider Alignment and Management Expertise

Capital Allocation

Reading the Tea Leaves

“Quality of the Business and Consistency of Earnings”

A struggling natural gas driller that plows all of its earnings into capex, or a Korean videogame studio with wildly variable earnings and no IR page will never be thought of as a “winner”.

Typical winners have growing, predictable earnings, stable margins, and are anchored in a respectable line of business. Avoid decaying sectors or “reputationally-troubled” groups (Greek shippers). Even if you find a name in a questionable industry that is well-run, it’s extremely unlikely the market will ever assign it a premium valuation. Understand that businesses that carry huge regulatory risk or wildly variable earnings (ZIM) will consistently trade at a discount to the market.

Pay special attention to industry outperformers. If your first thought is “growth”, think again. Industry outperformance can be something as little as managing downside risk better than peers (IGIC), or developing in-house technology that attracts zero-cost deposits (CUBI). The highest-valued names across industries always tend to have a moat or competitive advantage that sells the valuation, and you take note of an Investor Relations team that makes this competitive advantage a central tenet of their presentations.

Similar to dating, investors want to feel special - that they lucked out. Cheap will always be cheap, but a dynamic story like telehealth with exclusive partnerships (LFMD) or a regional insurer that has no competition after its two peers imploded (KINS) will always garner more attention from Institutional Investors, as they want a “Set and Forget” name that can continue to outperform.

“Insider Alignment and Management Expertise”

I can’t stress this enough, if the company you are looking at has an unaligned, overcompensated, incompetent CEO, it simply isn’t worth the stress of owning it. Remove it from your list immediately.

One of the first things I do when evaluating a company is I download the DEF 14A Filing (Proxy), and Control-F for “Summary Compensation Table” and “Beneficial Ownership of Management” to calculate an “Alignment Score”.

Alignment Score = Insider Ownership In Dollars / Annual Compensation

A healthy alignment score is > 5.

Take AMC Networks, for example. The insiders own a combined 7 Million Class A shares (currently worth $45 Million) and took $25 Million in compensation in 2024 and $30 Million in 2023. The alignment score for both years was barely above 1.5x.

With a market cap of just $280 Million, and the stock down roughly 72% in the last 5 years, it couldn’t be more clear the insiders are still living the high life while investors are getting flushed down the drain.

Management expertise isn’t just restricted to results or compensation, management expertise is also how leadership articulates themselves on earnings calls and in public. Pay special attention to CEOs / CFOs who make a compelling case for their own stock, and be weary of executives who doesn’t seem to grasp basic capital allocation principles.

For example, take the InMode CEO’s conduct on the Q3 2023 earnings call.

The fact that his capital allocation view at the time was that a buyback “is something that will have a few days and the market will forget that” because a peer with a buyback went down, did not inspire investor confidence in the name (the company is down a further 35% since the call).

While wealth is not an antidote to stupidity, the best way to ensure alignment is ownership. Executives should be reasonably compensated relative to the overall market cap of the company (never more than 5%, ideally less than 2.5%), and should have a stake several multiples of their salary.

If they don’t believe in the company, why should you?

“Capital Allocation”

Capital Allocation is what distinguishes value investments from value traps. Companies throw around terminology like Tangible Book Value and Price to Book all the time. But more important than a purported discount to book is whether the book value is realizable, and can be returned to shareholders.

What I mean by realizable is can the tangible book value be trusted and converted into cash? If a company continually impairs book value or the tangible book value is comprised of heavy industrial equipment and plants that likely can’t be sold absent a massive discount, proclaiming the company “trades at a fraction of book” is a very unconvincing argument.

Take Gravity (GRVY) for example. It trades at 1x Tangible Book (almost entire market cap in cash), 10x Earnings, and is in a reasonably attractive sector (Video Games). Yet over the past 5 years the annualized return has been just 1.5%? Why?

Horrendous capital allocation.

The company seems to have zero interest in repurchasing shares or paying a dividend, and investors who had hoped for one have been taken for a wild ride. Ultimately, poor capital allocation has defined it as a “loser” and despite the very reasonable valuation it simply won’t trade in line with the market until investors are confident that capital will be returned to them.

Compare and contrast that to IGIC, who repurchased millions of shares around book value while also paying special dividends along the way. In 2022 and even 2023, it traded at a discount to book, and it now trades at a reasonable premium as the share repurchase program and special dividends have instilled investor confidence that excess profits will ultimately be returned.

The rules to evaluating capital allocation are simple:

If a company has a strong balance sheet and is trading below book with ample cash flow / earnings, they should be repurchasing stock at a discount to book

A company should not be squatting on cash

If a company’s earnings are being plowed into capex just to remain “competitive”, you should assign a discount to the company relative to competitors with lower capex burdens

Steer clear of companies that tout a “significant discount to book” or a “compelling investment opportunity” while doing nothing to address the discount, they are either fools, or taking you for a ride.

“Reading the Tea Leaves” (Putting it All Together)

The three factors above are important, but you don’t want to miss the forest for the trees. Pay attention to buyback announcements, dividend hikes, even innocuous comments like a CEO refusing to engage in M&A because he’d rather repurchase his own stock (Pathward Financial), or a value fund with a history of success that continues to file Form 4’s as they purchase more stock - tiny updates and news should play a role in your analysis.

Another question you should always ask yourself is “what am I missing” / “why does it trade where it is?” Know that complexity is not rewarded, and if your thesis hinges on value being realized suddenly years or decades into the future, perhaps it makes sense to size your trade smaller until what you anticipate is finally beginning to happen.

Of the first three rules I mentioned, the only immediately disqualifying factor is poor management. Flexibility is important, it’s rare to find companies in a great line of business with skilled management and excellent capital allocation at a reasonable valuation - chances are these names are already trading at sky high multiples. Instead, pay attention to progress. If a Japanese name at 0.6x book pays a 3% dividend and announces a new repurchase program for 1-2% shares outstanding - that’s good enough. Progress doesn’t always come all at once, and patience in value trades is rewarded.

Putting It All Together - A Real Life Trade

I like Georgia Capital (CGEO:LSE). Georgia Capital is an investment holding company, with a 19% stake in the Georgia’s seond largest bank, Lion Finance Group, and a diverse portfolio of private Property and Casualty Insurers, Pharmacies, Hospitals, Renewable Energy Plants, and Utilities. (Original Write-Up on it at 1300, and I still like it at 1800).

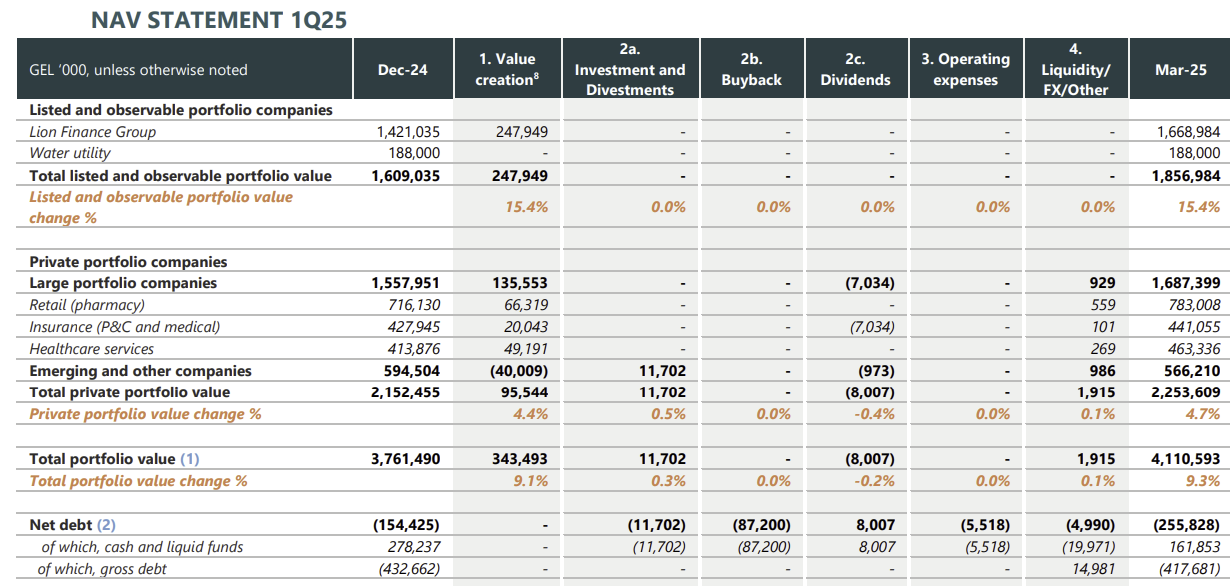

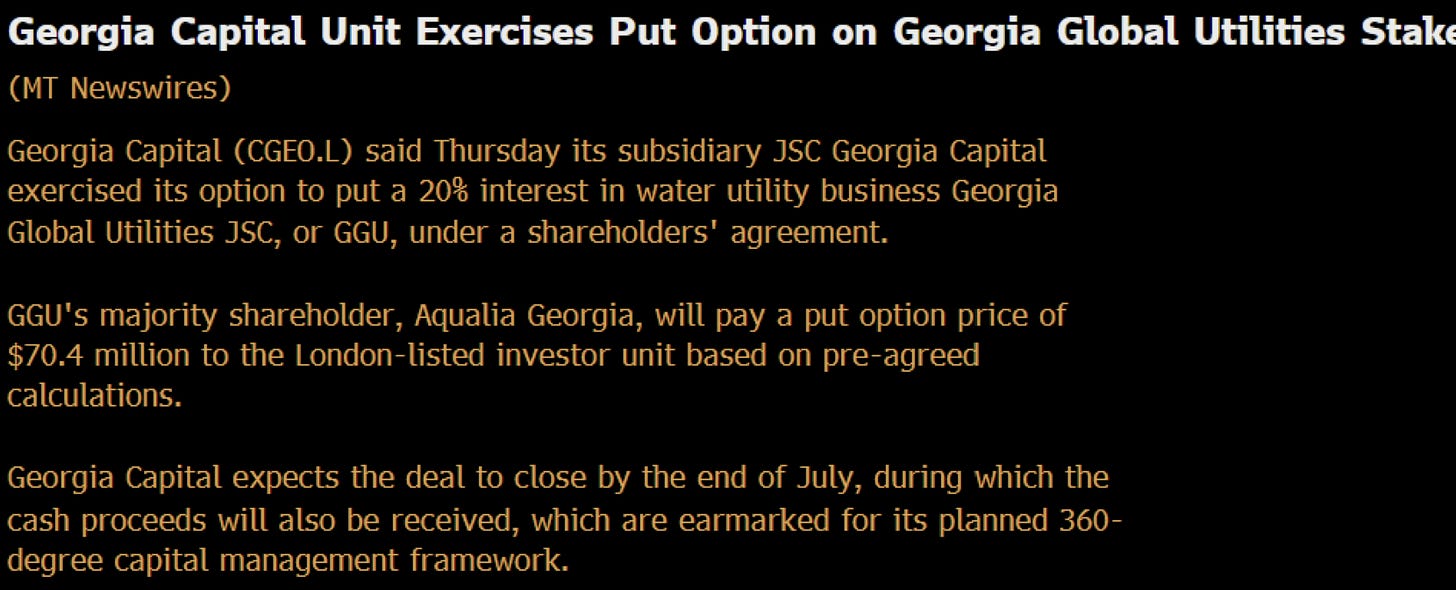

CGEO perfectly fits the mold of a turnaround name at a deep value multiple, trading at just 7x 2024 EPS and 0.6x Tangible Book Value. The earnings are strong and the Capital Allocation is especially impressive. The reason I like it now, even 40% higher than my original pitch price, is because the company just liquidated its stake in a water utility for $70 Million USD and essentially tells you in the pres release that the proceeds will be used to narrow the valuation discount by repurchasing additional shares.

Here’s a quick walk through of how the trade meets my “value trade” criteria.

“Quality of the Business and Consistency of Earnings”

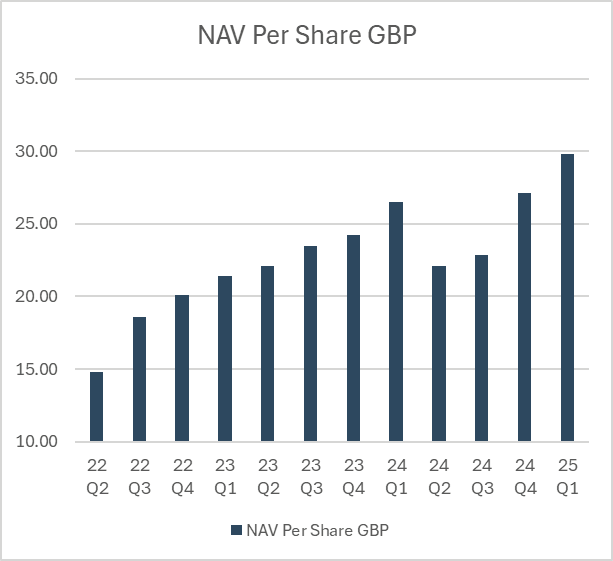

After a rough start from its spinoff from Bank of Georgia in 2018 (now known as Lion Finance Group), Georgia Capital has steadily grown its Net Asset Value per share.

The businesses continues to perform well, and its sizeable shareholding in Lion Finance Group has roared to a record high (up 28% since Q1) and now comprises nearly half of Net Asset Value. This is especially impressive, as the portfolio can be easily marked-to-market and thus we have the rare ability to estimate NAV on a daily basis.

Georgia Capital’s private portfolio continues to report near record EBITDA and Cash Flow, and last Friday the company announced it is divesting its stake in a Water Utility at book value, which is a positive as it converts more of the balance sheet into cold, hard cash. The diversified nature of its holdings (banking, healthcare, insurance, energy) and its outsized investment returns and close history with the second largest bank in Georgia lend credence to the argument that it has access to plentiful investment opportunities within the country, and that it can continue to grow.

“Insider Alignment and Management Expertise”

The Insiders currently own 5.8 Million shares ($150 Million USD), roughly 16% of the company.

Annual Executive compensation is around $4 Million USD, which results in an alignment score of 35x, certainly qualifying as “well aligned”. The CEO, Irakuli Gilauri, takes no cash salary and his variable equity compensation is almost entirely tied to the performance of the stock.

The company has a robust capital allocation plan in place. NAV per share has doubled since the end of 2022, and the stock is up an impressive 315% over the last 5 years (33% annualized). It certainly seems as though the Management Team is pulling the right levers at the right time. The company is shareholder friendly with well written letters, detailed presentations, and open conference calls. This is what I like to see.

“Capital Allocation”

Georgia Capital’s Capital Allocation is what I am most impressed with. After trading at a significant discount to Net Asset Value in 2021, CGEO began using a portion of its portfolio dividends to repurchase stock. Since then, the pace of share repurchases has accelerated significantly, with the company utilizing its cash balances to repurchase 3% of shares outstanding in 2022, 5% in 2023, 7% in 2024, and based on recent filings, more than 4% in the first two quarters of 2025 alone. Currently just 3% of the balance sheet is cash, down from 20% in 2022).

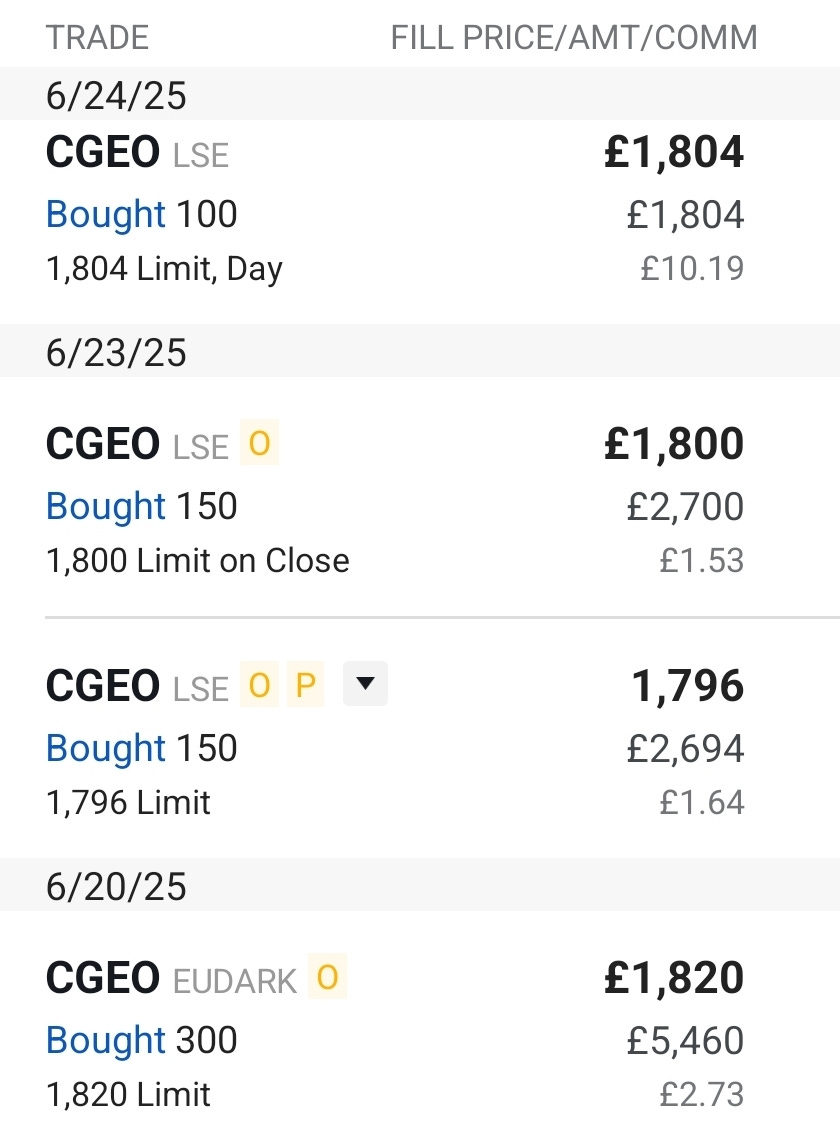

It’s especially interesting to note that the company significantly stepped up the pace of repurchases during the “Liberation Day” mayhem of early April in the 1300-1500 range, and also stepped in heavily on June 19th to repurchase shares at 1800 (when the stock was down 5%). It couldn’t be more clear the company is saying “we like our stock where it is currently trading”.

“Reading the Tea Leaves”

On Friday, the company announced it is exercising its put option to sell the water utility stake back to the majority owner for $70.4 Million, a tiny premium to what it was held on the balance sheet at. This is nearly 6% of net asset value being converted into cold hard cash, and lends credence to the argument that the company is laser focused on doing what’s right for shareholders, rather than throwing in good money after bad. Pay attention to the last line:

“The cash proceeds… are earmarked for its planned 360-degree capital management framework”

The company is clearly telling you that the funds will be used to finance further buybacks and narrow the discount to NAV.

Based on back-of-the-envelope math, the company is likely to report Net Asset Value per Share of 34.00 GBP in Q2, which represents 78% upside to where the stock was trading at on Friday.

CGEO pretty clearly meets my Business Quality, Management Quality, Capital Allocation, and “Tea Leaves” Criteria, now, we need to ask ourselves what are we missing?

Georgia is an emerging market with close proximity to Russia. Geopolitical risk and economic instability pose a sizeable left-tail threat to an investment. You don’t want to wake up one day and find out your investment is worth zero. Because of this, Institutional Ownership will likely remain muted. For Institutional Investors, it’s way easier to explain losing money on Apple than getting zeroed on a Georgian investment conglomerate.

On the other hand, with that kind of logic, a good chunk of world equities are uninvestable; Taiwan Semiconductor, Middle East Equities, etc. There is a price for everything.

At just 0.6x Tangible Book (really 0.55x after adjusting for the increase in BGEO), an excellent management team, robust capital allocation that not only stabilizes the stock at the current price by repurchasing 30% of the daily volume, but is also likely to be reinforced by $70 Million USD after the sale of the water utility later this summer, I think you can make a very strong argument that CGEO is compelling at the current price.

What’s a fair price?

There should also be some discount to tangible book for emerging market investment holding companies, so if you settle on 25% we get to around 2,475, and at 33%, 2,200. Both “targets” are significantly above the current price, which is why I have been adding here.

Even assuming a lower Q2 Net Asset Value of 3,300, the upside to tangible book is favorable at 1900 (74%), and even more so if the price returns to 1700 - 1800.

Given the geopolitical risks present, I initially sized CGEO at a small weight, and have carefully added to my position in the 1775 - 1825 range to bring it into the 0.5% - 1% range. I still have some Market-If-Touched orders in the low 1800s; the company has been repurchasing heavily in that range which I think that favorably skews the risk-to-reward.

You never want to enter a new position too quickly. If this is a name you are interested in, it makes sense to add a starter position and leave yourself additional flexibility to add at much more favorable risk-to-reward levels (1700 - 1800), should the opportunity arise. On the other hand, if the price flies away to 2,200, it’s still a win. Given the left tail risk present with anything with geopolitical exposure risk, you never want to size too heavily on a name, but even a small 0.5% position can add “torque” to your portfolio given the extremely attractive valuation Georgia Capital is trading at.

Be mindful that the lower the price remains, the more favorable share repurchases are. Every share repurchased at 1900 generates about $19.18 USD of additional Tangible Book Value for the remaining shareholders (14 GBP x 1.37 GBPUSD), and so the best case scenario for long term value creation is for the company to continue repurchasing 10,000 - 30,000 shares a day in the present 1900 - 2000 range. You should note that a 0.5% “Stamp Tax” is levied on all LSE Equity Trades, so this is not a candidate for a quick trade, but a long term hold (unless you have access to tax exempt CFDs).

Hopefully, you’ve enjoyed this piece and gotten insight into my basic framework to discern value trades from value traps. I am planning on getting out a detailed piece on the Japanese equities I’ve been adding to recently, and sharing some fresh ideas shortly.