Tis The (Earnings) Season

Updates on the High Conviction Trade Series - What I'm Looking For Next

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

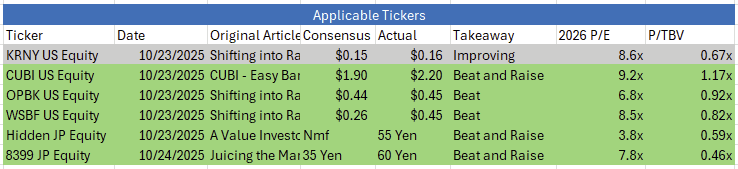

It’s been a busy start to earnings season. Five out of six names covered in previous articles reported excellent results, and more are set to report this week. I wanted to briefly discuss each report, some recent events (Argentina Elections and a Potential China Trade deal), and the setups I find most attractive.

At the time of writing (Sunday 7:39 PM), preliminary results indicate Javier Milei’s party, La Libertad Avanza, is headed towards a decisive victory.

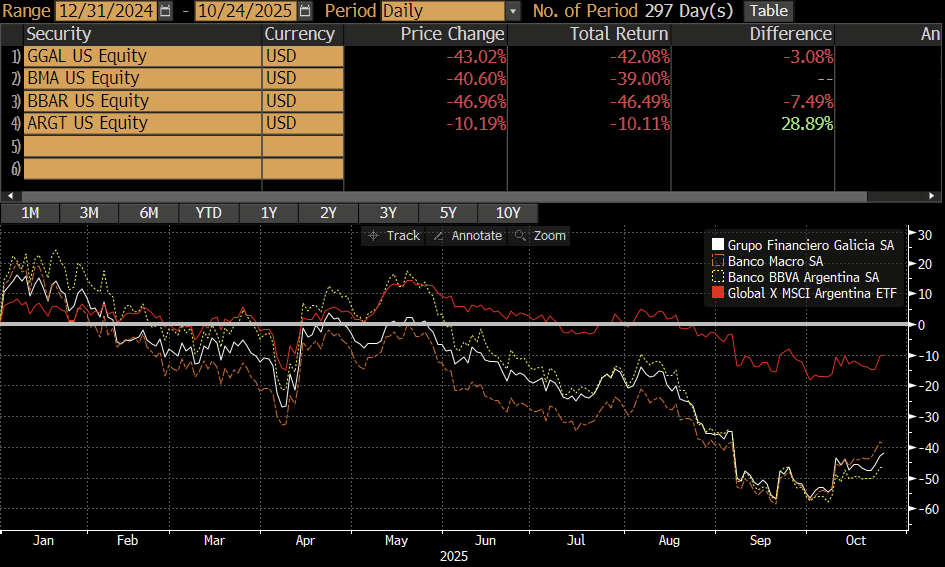

I’m long a small basket of Argentinian Financial Institutions, all of whom were trashed this year over fears that Milei’s pivot to Free Markets would be overturned at the ballot box. Grupo Galicia, Banco Macro, and Banco BBVA Argentina have heavily underperformed the MSCI Argentina, and if Milei’s party indeed secures 40%+ of the vote I think the combination of US Support (via a $20 Billion Swap Line to support Argentina’s currency) and political certainty for the next two years will provide an excellent backdrop for these banks to recover much of their 2025 YTD losses.

I certainly don’t expect them to bounce back to 0% YTD within a day, but the names should be up 15%+ given the lethal bear case is now entirely removed. The reaction today is likely to be “kneejerk”, so if you are interested in Argentinian banks, I think it make sense to wait and see how things settle out this week.

Nonetheless, I think the “Argentina Comeback” trade is one that will last for a while given Milei’s free market reforms, and that regardless of today’s knee-jerk move, the positive trend among Argentinian financials, energy (YPF), and airports (CAAP), will continue for some time.

It also seems a “Sweetheart” trade truce between the US and China is on track. Both sides are already drawing attention to the meeting and praising the “tough but understandable stance” of the other negotiators, so that they can both play off an agreement as a win. Will anything of substance happen? Probably not, but mere reassurance is enough to get markets happy again.

Most names within the “Tariff Slime” basket have already recovered from the April 4th lows, but I think increased trade certainty could benefit names heavily associated with product sourcing from China and Southeast Asia such as Gigacloud Technology, Sonos, and Jakks Pacific, as well as tech names such as ACM Research (semiconductor cleaning equipment) given the prospect of a chip-war detente.

Between Argentinian Banks and “Tariff Slime”, I think Argentinian assets provide a more favorable long term setup, but given the event-driven nature of today’s market and a massive fixation on “themes”, I think both groups are worth paying attention to today.

Earnings Analysis and Setups

1. Customer’s Bancorp

Multiples: 8.9x 2026 EPS, 1.17x Tangible Book Value

Reported: $2.20 vs $1.90 Estimate

Takeaway: Strong Beat and Guidance Upgrade Boosts 2026 Outlook

Customer’s delivered a significant beat. The quarter was marked by excellent credit quality, accelerating loan growth, and increasing deposit activity driven by its newly hired banking teams.

The regional bank industry has been plagued by credit “cockroaches”, which makes Customer’s beat even more impressive. Customer’s dispelled any concern over its sizeable NDFI (Non Depository Financial Institution) loan book, stating:

Most of the recent attention this past quarter has been on the lender finance space. For Customers, this is one of the oldest specialized lending businesses we’ve been in. It’s one we’ve been in for over a decade, and we’ve not only had zero losses, but zero loan defaults. In this business, this is typically lending to a private credit fund where the collateral is a broadly diversifies pool of loans out to middle market companies. There’s significant overcollateralization. We have low advance rates and there is a -- it’s very diversified. So our single obligor exposure is very low, kind of mid single-digit. So when you put all those things together, it’s translated into, again, zero losses, zero defaults.

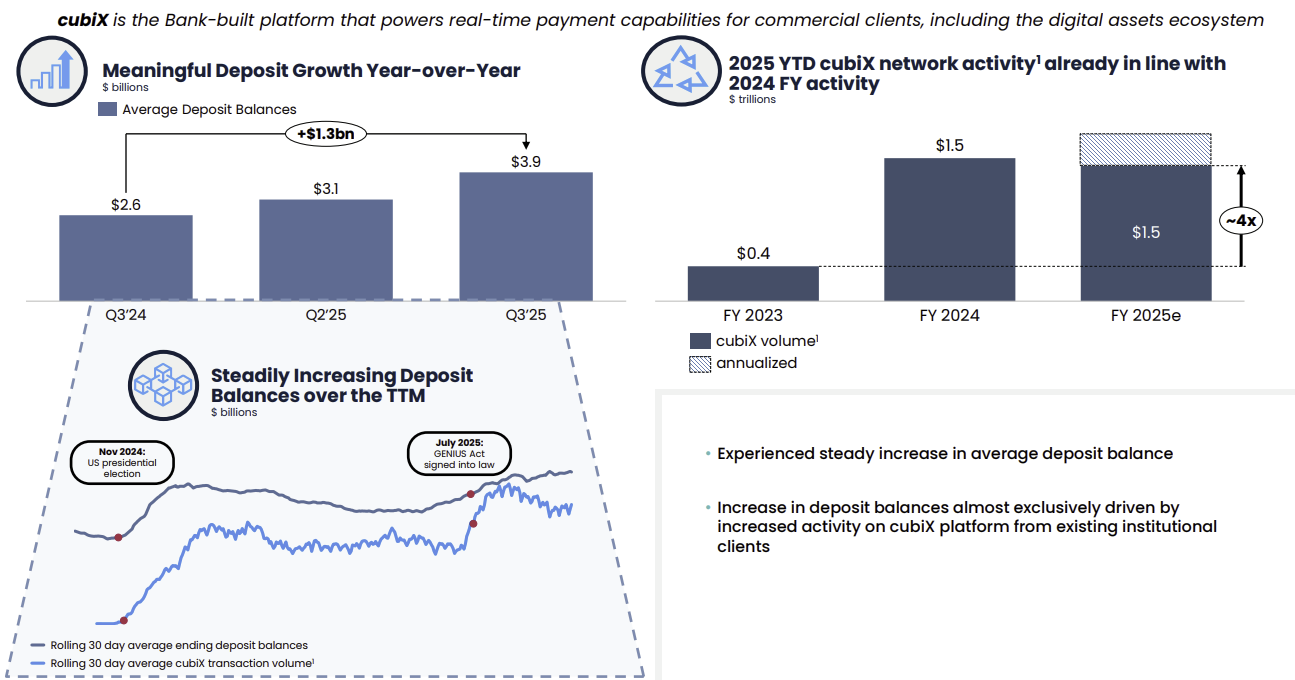

Customer’s also highlighted the success of its proprietary CUBIX offering. CUBIX is a private payments rail (similar to Zelle, but for Insitutions) that allows clients to transfer hundreds of Billions to other Customer’s clients. The primary use case for this is Institutional crypto activity. CUBIX is integrated across all major exchanges and most trading desks, and comes with an added element of security relative to pure stablecoins like USDC or Tether, since CUBIX can only be transferred to other Institutional CUBIX clients, and thus can’t really be stolen or hacked by third parties.

Customer’s has brought in nearly $3.9 Billion in zero-cost deposits (which they store in cash to minimize liquidity risk) via CUBIX, and growth has been accelerating as crypto trading volume hits record highs.

Customer’s provided very rosy guidance in terms of organic deposit growth, stating that its new 2025 hires are likely to give a “25% lift on the $300 - $400 Million” in quarterly deposit growth, starting in the middle of next year.

What I like about Customer’s is that time is on its side and that its successes build upon each other. Unlike other regionals stuck with low-rate securities or deteriorating office loans, Customer’s winning technology solutions such as CUBIX, and its highly successful new banking teams (poached from Flagstar, Signature, and SVB) contribute to the bottom line immediately and help it secure new opportunities and clients. Simply put, it’s a growth story, not a value story.

Despite Customer’s history of success and its impressive 46% YTD return, it still trades at a steep discount to the broader regional banking index (9x 2026 EPS, 1.17x Tangible Book Value vs 10x 2026 EPS, 1.47x Tangible Book Value for the index). Customer’s has differentiated itself from peers via its proprietary offerings such as CUBIX, its minimal credit risk, and its consistent growth track record, and as analysts slowly bump 2026 estimates up from $7.50 to $8.00 and as investors warm to the name, I think additional upside is present. A baseline case would be for it to trade at the Regional Bank peer multiple (implying $80 a share) and an optimistic case would be for it to trade at 11-12x earnings (implying $88 - $96 a share).