Betting on Capital Markets with a Value Twist

1.05x Tangible Book Value and 9x Trailing Earnings - Too Cheap to Ignore?

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

I wanted to write a brief update on my position in Oppenheimer Holdings (OPY) and run through the "Value Trade" checklist.

Oppenheimer Holdings is a middle-market investment bank and wealth management firm with a focus on Healthcare, Technology, Municipal Bonds, and “Baby Bond” / Preferred Stock offerings. Over the past two years, its consistently profitable Wealth Management Division has been overshadowed by steep losses in the Capital Markets Division due to slowing M&A and deal flow.

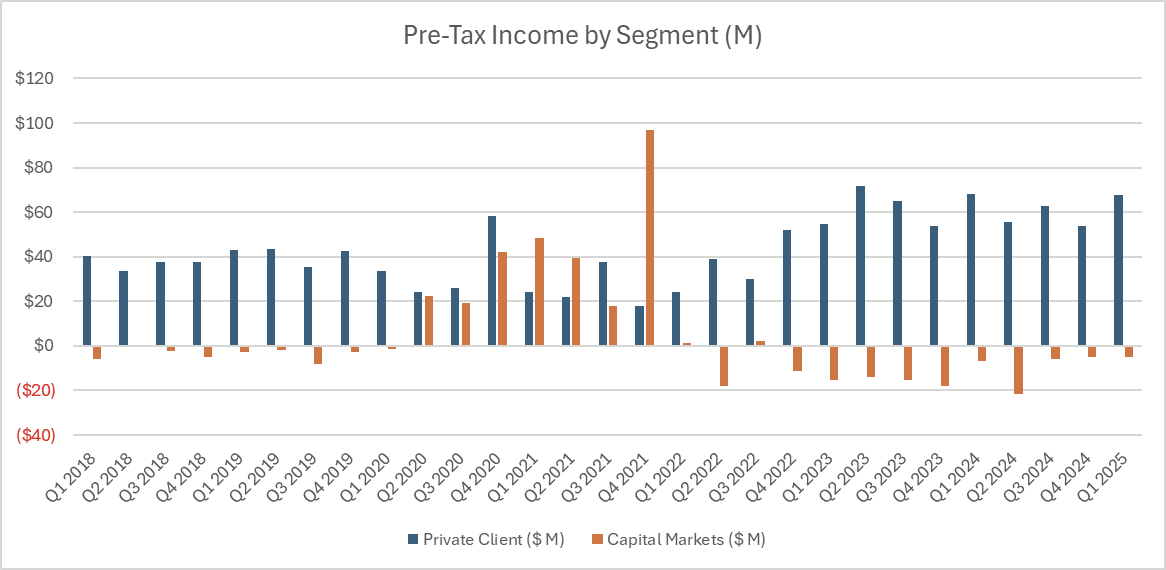

After the small cap / SPAC mania of 2021 faded, Oppenheimer’s Capital Markets Division swung from $30 - $90 Million in quarterly pre-tax profits to $15 - $20 Million in quarterly losses as a result of depressed deal activity and an unfavorable small cap backdrop. Oppenheimer immediately began restructuring, largely pausing new hires in the Capital Markets division and merging the Private Client and Asset Management segments into Wealth Management. The efforts are yielding results - losses in the Capital Markets Division have narrowed from a quarterly $15 - $20 Million in 2023 to just $5 - $6 Million in 2024, and I believe they are on track to turn positive once again in 2025.