Riding the Uplisting Wave

Uplisting Basics - What They Are and How to Find Them

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

How to Source and Evaluate Uplistings

Putting It Together - A Real Life Trade

Uplistings.

There’s tremendous opportunity in monitoring new NYSE and Nasdaq listings, but not in the way you think. The real edge isn’t in red-hot IPOs at sky-high valuations, but rather “graduates” from the Over-The-Counter Market; forgotten, discarded businesses with rapidly inflecting prospects who regain enough fundamental footing to be admitted to the “big leagues”. If conducted properly, an exchange uplisting can serve as a massive catalyst, drawing Equity Research attention, enabling Index Inclusion, and ultimately opening the floodgates to Institutional Capital.

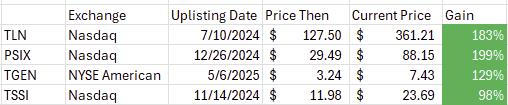

Some of the most extraordinary winners of 2024 and 2025 have been uplistings as the AI / Electrification Boom resuscitates businesses back to life.

Power Solutions, for example, is up nearly 199% since its uplisting and more than 40x its April 2024 low of $2.00. After fending off near bankruptcy, Power Solutions took advantage of heightened AI demand for power systems and soaring revenues and profits grew shareholder’s equity from just $3 Million at the end of 2023 to $65 Million at the end of 2024. Given its significantly improved financial footing, Power Solutions was able to re-list on Nasdaq in December 2024, nearly 7 years after it was first delisted in April 2017.

The flood of institutional capital has continued. After a brief drop to $20, the stock has since soared to $88; it is now an “AI Darling” and a Russell 2000 component.

Talen Energy (TLN) is a similar story. After emerging from bankruptcy in May of 2023, the stock languished on the Over-The-Counter market despite rapidly improving fundamentals as a reuslt of skyrocketing power pricing. Earnings and Cash Flow surged as the company reduced its share count through a highly unusual tender offer in June 2024 at $116. It was uplisted to the Nasdaq in July, becoming “accessible” to Institutional Investors who were precluded from trading OTC names. It is up 183% since then.

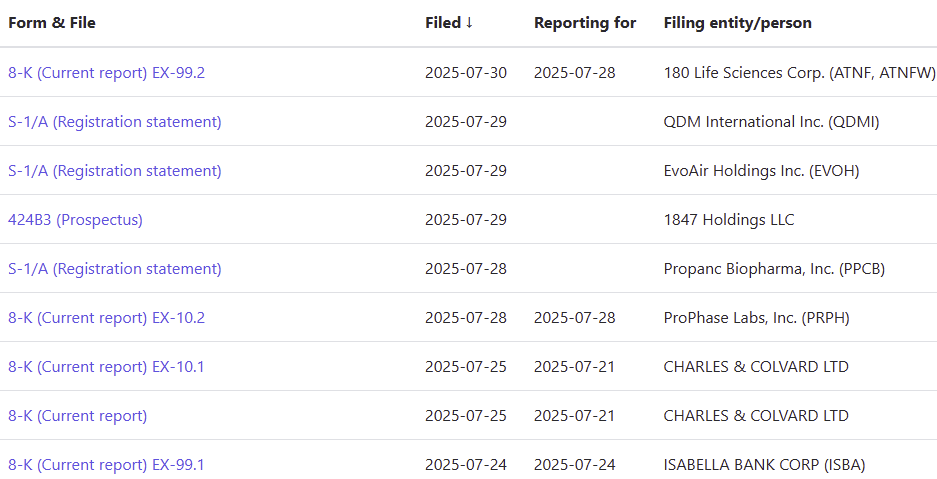

It’s incredibly easy to find uplistings before they occur. All you need to do is the control-F equivalent for “Uplisting” on Edgar - use its full-text search functionality. In fact, I’ve already done the work for you, just click here.

Nearly every company announces its intention to uplist months in advance; I check this link daily to maintain a list of uplistings in progress that I am interested in, as well as those that will soon be effective.

Checking daily might be a pain, but it is a great way to spot opportunities before others.

An uplisting itself isn’t a sure sign of success. You could run through the value trade checklist, but there is an even easier way to filter out the potential winners from the garbage. Ask yourself a very simply question, why is this company uplisting?

If the uplisting is pre-revenue company, in a disreputable industry, or simply a shell game like Bitmine Inversion Technologies becoming a crypto treasury company, it’s an immediate red flag. Stay away from companies who have uplisted for the purpose of raising additional capital by selling fresh shares. Many times a reverse-merger uplisting is simply a way to avoid the regulatory scrutiny of an IPO. While you might be able to win, in general you will serve as someone’s exit liquidity.

Instead, focus on companies that are already profitable, growing, and have a strong or inflecting story. Chances are the uplisting is intended to boost visibility and provide long-term holders with additional value and improved liquidity. Pay special attention to names that are buying back shares into the uplisting, like Talen Energy did, this is a strong signal.

While not all uplistings are success stories, incorporating a simple once-a-week check of Edgar is a great way to source fresh ideas, provided you are a skilled, active, investor. Uplistings are a prime hunting ground to identify and get in on inflecting businesses, before Institutional Investors can.

Here’s one that has caught my eye.