A Value Investor's Paradise

What to Focus On and Common Pitfalls to Avoid with Japanese Equities

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions

Welcome to Japan

Roses and Thorns - What to Look for and What to Avoid

Using Repurchase Reports to Your Advantage

5x Earnings, Half Book, and a Hidden Investment Portfolio

Welcome to Japan

A Value Investor’s paradise or a bottomless pit where money goes to sleep? In all honesty, Japan’s probably a mix of both.

It’s a remarkable place where nearly everything is optimized. The trains run on a 15-second schedule, the streets of Tokyo are lined with vending machines to ensure you never have a thirsty moment, convenience stores are stocked with everything from gourmet meals to fresh shirts and even the bathroom greets you with a cute jingle as you sit down (always fun “making music” on the toilet).

The same goes for companies. Salarymen work withering hours, executives are scantily paid and constantly update guidance, and most investor relations decks look like a 50-slide invasion plan.

The only downside? Most companies are hesitant to pay out profits.

Some experts attribute this to a societal sense of risk aversion, others, as a financial response to the “Lost Decades” from the 1990s to the mid-2010s where the Nikkei imploded from 38,000 points to just 8,000. The aversion to paying out earnings is also compounded by the unusual structure of Japan’s large cap market: most companies own substantial stakes in publicly traded subsidiaries, as well as competitors.

For example, Mitsubishi Shokuhin (7451) is a wholesaler of processed food and beverages and a member of the Mitsubishi Keiretsu Family (a term for large corporations with a network of subsidiaries and cross-shareholdings). Mitsubishi (8058) owns 50.50% of Mitsubishi Shokuhin Co (7451), and Mitsubishi Shokuhin itself owns 37 different stakes in its own suppliers. What a wild web. It’s difficult to focus on shareholder returns when so much time is spent juggling stakes in peers, and it’s also difficult to exercise pricing power when doing business with a parent company that owns a majority stake. (Mitsubishi recently bought out Mitsubishi Shokuhin at a massive premium).

The cobweb of cross shareholdings and abusive parent-subsidiary relationships stymied capital returns and M&A for decades, but the tide has begun to turn.

In 2015 the Japanese Government and the Financial Services Agency passed a regulation that required companies to disclose the rationale behind cross-shareholdings, and encouraged institutional investors to vote no on any cross-shareholding proposals. The government took further action by removing tax shields and simplifying the tax code to make it easier for large corporations to exit equity positions.

The efforts intensified in 2022 when the Tokyo Stock Exchange announced a new “Prime” Listing Segment. The segment imposed strict criteria on corporate governance and required intricate disclosures on plans to “Improve the Price to Book Ratio and Return on Equity”. This implicitly pressured companies to begin winding down cross-shareholdings and to pay out excess cash in the form of dividends or share repurchases in order to remain eligible for the segment.

The efforts were massively successful, and an influx of share repurchases and dividends began what has been a nearly five-year bull run in the Nikkei (if you exclude the two mini-panics).

The Tokyo Stock Exchange took further action in 2024 by initiating a “name and shame” applicable to all market segments. Companies were given the opportunity to file a disclosure called “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price” (perhaps the most Japanese thing I have ever heard), where they could outline specific targets for Return on Equity, Payout Ratio, and their overall framework to boost shareholder returns.

A monthly Excel sheet is published and shows which companies have released the disclosure, and additionally, which companies have responded in English as well. The Excel list is published here.

The central thesis of most of my Japanese Value Trades isn’t to focus on growth, but rather on setups where the value already exists and is simply being returned to shareholders.

The Tokyo Stock Exchange Excel Sheet is a great place to start - if you have two equally compelling fundamental setups where one company has already published its disclosure and the other has not - it should be an easy decision.

Roses and Thorns - What to Look for and What to Avoid

Before we get into what to look for, there are some obvious “value trap” setups to avoid.

The first and most common are controlled subsidiaries of larger Keiretsu. Many of these names lack pricing power as a result of their complicated relationships with their parent companies, and they lack the independence necessary to return profits to shareholders.

While you might get an “acceptable return” over the long run, most of these subsidiaries are textbook value traps that have significantly underperformed peers, their parent companies, and the broader index over the last decade.

Toyota Boshoku (3116), a supplier of automobile products and textiles to Toyota, is a great example. While it may appear optically cheap at 8x earnings and a 4% dividend yield, its parent company Toyota owns nearly 48% of the shares outstanding. Margins have been declining and despite a massive cash pile, shareholder returns are minimal; the company is simply “under the thumb” of Toyota. It’s a difficult spot to be in - do you think Toyota would be happy if Toyota Boshoku raised the price of car seats by even 2%? Of course not. In order to please their corporate overlords, they’ve thrown shareholders under the bus.

Another setup to avoid is companies where the majority of equity is comprised of disproportionately large cross-shareholdings. For example, Kyocera (6971) is trading at ¥ 1627 with Tangible Book Value of ¥ 1950, but almost half of that tangible book value is comprised of its stake in KDDI (9433). You can say “it’s at a discount to book value” to back your thesis up, but unless strategic cross-shareholdings are being wound down, the Tangible Book will never be converted into repurchases or dividends if the position is held for “strategic reasons”. (Interestingly Kyocera sold 20% of its KDDI position last month, the first sale since 2016).

The last, and most obvious trap to avoid are companies with zero outreach or blatantly bad corporate governance, as we discussed earlier. Using a basic screen like:

< 10x Earnings

< 1.5x Tangible Book

Net Cash as % of Tangible Book > 70%

You’ll find no shortage of results, and most of them trade the way they do for a reason.

The most prominent example I came across is RS Technology (3445), which trades at ¥ 2960, 8x earnings, 1.2x Tangible Book Value, and ¥ 2,450 of Net Cash Per Share. It’s undoubtedly cheap. The path to improving shareholder returns is obvious: buybacks, but the company has no interest in reaching out to the shareholders and is instead focused on establishing new subsidiaries in China. Simply put, in names like this where capital is not being returned and Investor Relations makes little effort to discuss shareholder returns, it’s unlikely you will see a positive one.

There are also three factors I pay close attention to in determining if a value trap has the potential to be a turnaround story.

The first and most obvious is when the company guides an increase to its payout ratio (percentage of income returned to shareholder via dividends and buybacks).

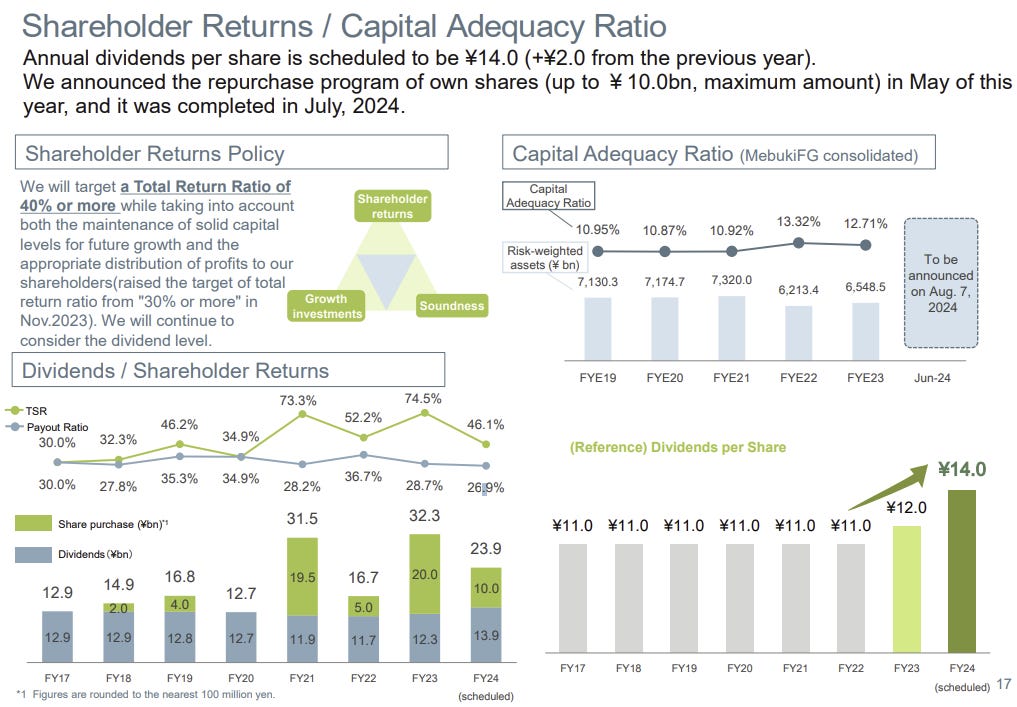

In early 2024, Mebuki Financial (7167) was trading at half Tangible Book Value and announced concrete plans to boost its payout ratio to 40%. The message couldn’t be more obvious: they were dissatisfied where they were trading, and would use buybacks and dividends to force the market to realize the value they were building.

The stock has since risen more than 60%.

Another great setup is when a company with large cross-holdings announces a strategic goal to unwind its positions. This immediately vaults a value trap to a value trade.

In 2024, MUFG and Sumitomo Mitsui Financial Group announced their intention to divest their $8.5 Billion stake in Toyota and use the proceeds to fund buybacks. Both stocks are up 40% following the announcement.

These setups are easy and obvious because they aren’t about creating value via future growth, but rather monetizing existing value by converting Tangible Book Value into cold hard cash.

The final thing I look for is a bit niche and highly applicable to small caps. Many Japanese companies offer Yutai - shareholder gifts. The gifts are exclusive to Japanese residents and dependent on levels of share ownership.

For example, if you own 100 shares of McDonald’s Japan you get a free annual meal, if you own 500+ shares of JR Rail you get a discounted train ticket. It’s a cool concept and a very charming aspect of Japanese culture.

Nonetheless, as an American I’d rather be paid a dividend since I can’t use any of the shareholder perks. In recent years, many Japanese companies focused on boosting shareholder value have swapped out Yutai for higher dividends and repurchases, which have driven mouth watering returns.

For example, in 2021 Tanabe Consulting (9644) announced it was eliminating its annual ¥ 3,000 ($20) diary gift and that it would instead:

“provide returns through dividends (based on shares held) and, in the long term, share buybacks are more appropriate”

They also announced a shareholder friendly split, and the share price has since doubled.

While the elimination of shareholder perks is by no means indicative of a promising investment on its own, it demonstrates a company is focused on boosting shareholder value. (Although now that I am writing this, I have to say I think Yutai is a charming aspect of Japanese culture and I hope it doesn’t go away entirely - just on the names I own).

Using Repurchase Reports to Your Advantage

I love repurchases as a form of returning capital, and one of the best things about Japanese corporate governance is that repurchase plans are detailed and timely. When companies want to repurchase shares they will announce an authorization for a period typically up to three months, and include a set target with an upper limit on quantity and notional value. Updates on the program are provided monthly.

These updates are usually posted on their Investor Relations page. Use them to your advantage.

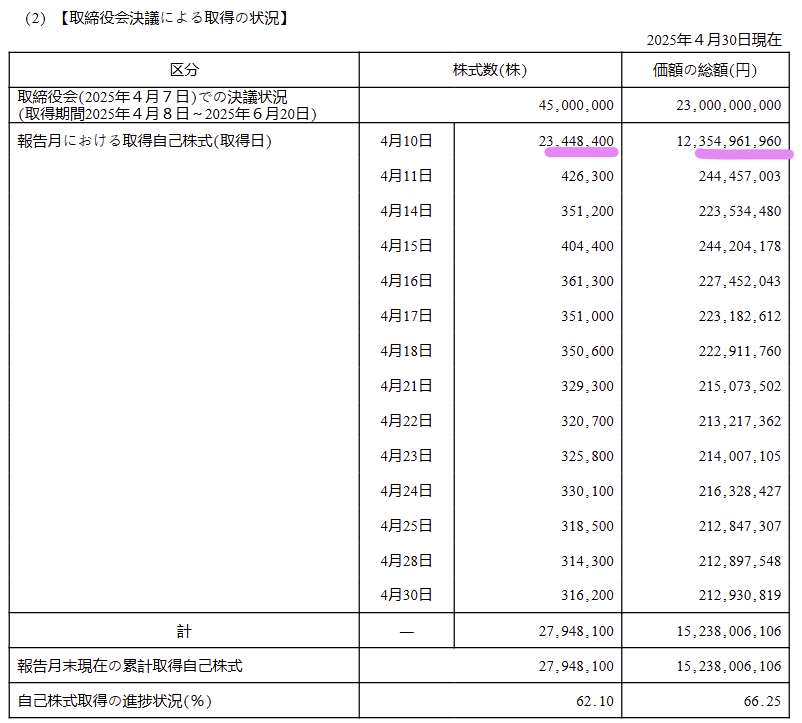

For example, one of my favorite Japanese banks, Mebuki Financial (7167) published in its April Repurchase Update (May 2) that it went “balls to the wall” repurchasing 23.5 Million shares during “Liberation Day” at ¥ 526 Yen and that it continued repurchasing shares even at a much steeper ¥ 673 Yen.

It doesn’t take a genius to realize this means they have a significant appetite for their stock between ¥ 526 and ¥ 673.

By reading repurchase reports, you can structure a beneficial risk-to-reward trade setup by adding to your position at the same levels a company has an “appetite” for their stock. This provides significant downside protection as share repurchases are likely to intensify at lower levels, providing a favorable short-term setup.

In case you are curious, the stock has since risen to ¥ 780 in June.

5x Earnings, Half Book, and a Hidden Investment Portfolio

It sounds too good to be true, doesn’t it?

The name I am about to discuss is incredibly small and surprisingly liquid. Most investors haven’t realized that the company “gem” is not the core operating business, but rather the massive Securities Portfolio the CEO has built.

Say what you will about Microstrategy, but the fact it trades at a Premium to Book Value is a tremendous asset since it can issue new shares at a Premium and increase overall Book Value per Share for existing shareholders.

In a similar vein, the fact that this company trades at just half of its book value provides a tremendous opportunity for the company to continually grow Tangible Book Value per share by conducting massive share repurchases at a discount.

Now, let’s get into it.